- Enterprise services are seen as vital to 5G success

- Cradlepoint specializes in 4G/5G indoor/private network wireless access tech

- Cloud-oriented model will boost Ericsson’s overall offer to telcos

- Deal should help it catch up with rival Nokia in private networks market

Ericsson has bolstered its enterprise 4G/5G tech portfolio with the acquisition of Cradlepoint, an indoor/private network wireless technology specialist, in a deal valued at $1.1 billion that should help it compete more effectively with Nokia in a key market.

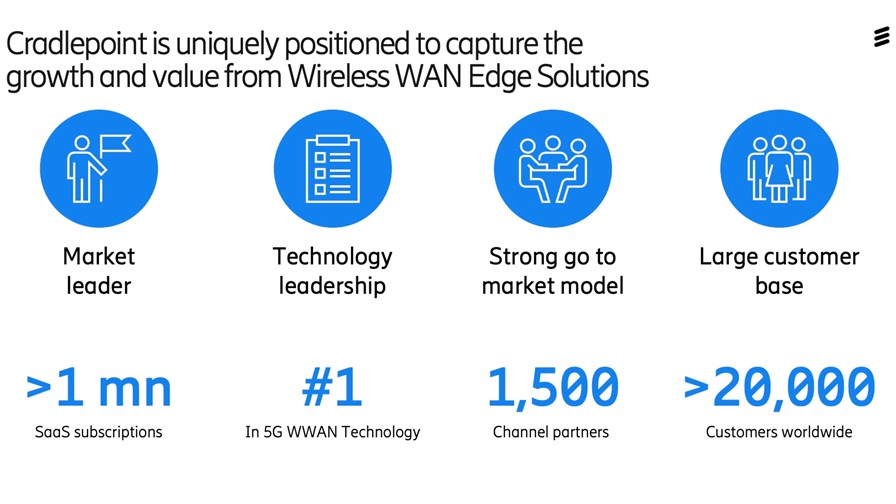

Cradlepoint, a long-time Ericsson partner, has developed a range of cellular and WiFi access points and cloud-based management software designed to provide high-quality services in local areas, such as inside buildings (where 5G in particular needs help) and campus/private networks. It has more than 20,000 customers, 1,500 channel partners and is set to grow its revenues by more than 30% this year.

Ericsson says this complements its “existing 5G Enterprise portfolio which includes Dedicated Networks and a global IoT platform,” and it’s important that Cradlepoint has already developed software for centralized management from private or public cloud platforms, as that’s the model that network operators and enterprises are embracing, and offers its products on a subscription basis, which again is a popular model with enterprises.

The move makes a lot of sense for Ericsson, as it will boost its direct business opportunities with enterprise customers but also further strengthen its hand with the telco community. The mobile operator community needs a way to get a return on their 5G investments, and enterprise services in all their guises are seen as the most likely source of incremental sales. But to do that, the operators will need to guarantee high-quality, flexible, reactive and relevant wireless data connectivity to their business customers and that means having the technology that can deliver against service level agreements (SLAs) inside buildings, in specific locations (remote sites, campus settings etc) and in private network settings. Ericsson needs to be able to deliver to operators’ needs for wide and local area wireless networks, and Cradlepoint, which launched a “5G-optimized, all-in-one wireless edge router for enterprise branch deployment” in May, certainly strengthens its hand in what the Swedish vendor calls “Wireless Edge WAN 4G and 5G Enterprise solutions.”

Boise, Idaho-headquartered Cradlepoint has more than 650 staff, recorded annual revenues in 2019 of about $137 million and is expected to report full year revenues of about $182 million for 2020 (an increase of about 33%). It operates in a growing market – Ericsson believes the market in which Cradlepoint operates is growing at about 25-30% -- but it is also an increasingly competitive market, where one of Ericsson’s main rivals, Nokia, has arguably stolen a march to date with its private networks offering. (See Nokia is touting 5G standalone as a feature of its industrial-grade private wireless offer and Nokia is breathing life into the private wireless network market.)

The cash acquisition, which is set to close before the end of the year, values Cradlepoint at $1.1 billion: Ericsson says the deal will impact its operating margin by 1% in 2021 but contribute to its profitability from 2022. Ericsson’s investors seem to like the deal, with the Swedish vendor’s share price up by 1.3% Friday morning to SEK98.26 on the Stockholm exchange.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.