Source: Accedian Research

- Maybe several will - it’s a complex area and the fact that a hybrid is the most popular currently mooted perhaps illustrates the level of indecision

- Telcos are well positioned to play a big role in private 5G, it’s just that it may take a long time

The future of private 5G networks is wide open in terms of what players, or types of player, are likely to predominate. One thing most observers agree on is that private 5G for industrial and manufacturing applications is going to be huge and will comprise the most important segment for the new technologies, spearheading the adoption of the corporate and business 5G use cases which together are predicted to become at least as important revenue-earners as device-based mobile broadband in 5G.

That’s where the clarity ends. There are so many different ways that industrial 5G could be deployed and so many competing business models aiming to orchestrate its delivery, that it’s very difficult to take a view on which of them will do well in that crucial manufacturing sector.

Performance analytics and cybersecurity specialist Accedian has produced a report in partnership with Analysys Mason to examine the options.

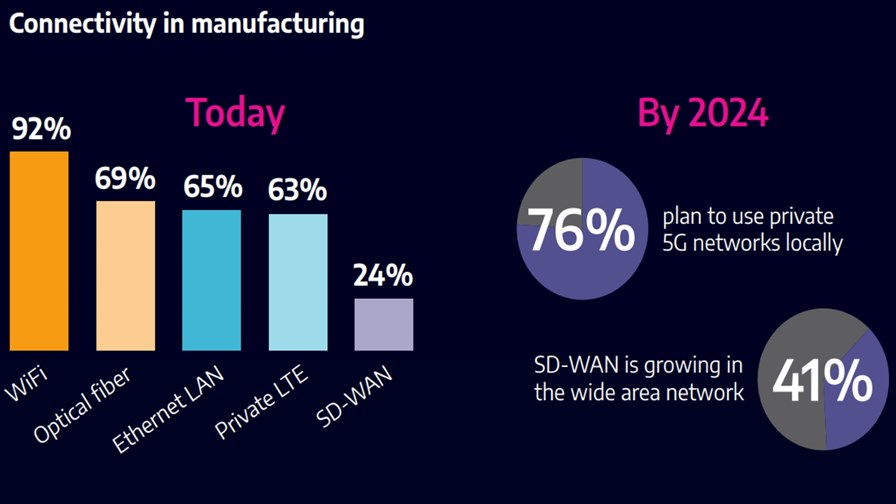

The researchers have no doubt that manufacturing holds “extreme promise” for 5G - they surveyed enterprises in the manufacturing sectors of the US, Germany, UK and Japan to find out what they actually wanted. High reliability came in at 82%; security at 78%; support for low-latency applications was 75%. That meant a 5G private network was an attractive option for them - at least on paper. In fact 76% of manufacturers already planned to use private 5G locally by 2024. But how?

The research showed that the most likely types of 5G deployments were: hybrid models (45%) and network slice (35%); while 18% of manufacturing respondents prefer fully private on-prem networks. Given this rather mixed set of messages for telcos, how should they seek to maximise their impact?

I asked Sergio Bea, VP of Global Enterprise and Channels at Accedian, whether telcos should try to improve their vertical knowledge and focus to compete with the integrators, say, or seek completely different approaches?

“Service Providers haven’t figured that out yet,” he says. He said it was important to remember that every time telcos had tried to reach out beyond their established competencies in the past - to go after content applications for instance - they hadn’t been successful. With private 5G they could look to buy in competence by acquisition, they could form strategic alliances with prominent integrators; they could hire in talent and set up their own specialist divisions to tackle verticals; they might even do MVNO deals with likely integrators to offer private 5G slices - although Sergio hadn’t heard of this being done, it seemed like a possible avenue of attack.

“I think that the biggest challenge with the hybrid model is orchestration, management and service level assurance,” he says. “It’s very complex and is the most important thing they need to tackle.”

“Overall telcos are well positioned to play a big role in private 5G, it’s just that they’re going to take a long time,” he says. “Personally, I think the best way forward for them is to use baby steps - get a specialist team together to tackle one or a handful of verticals, find some willing customer partners and learn from there; build new teams from scratch to tackle different verticals while learning what they can from the existing teams. I think the speed with which they can acquire the necessary talent could be a determining factor in this.”

You can find Accedian’s report here

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.

Subscribe