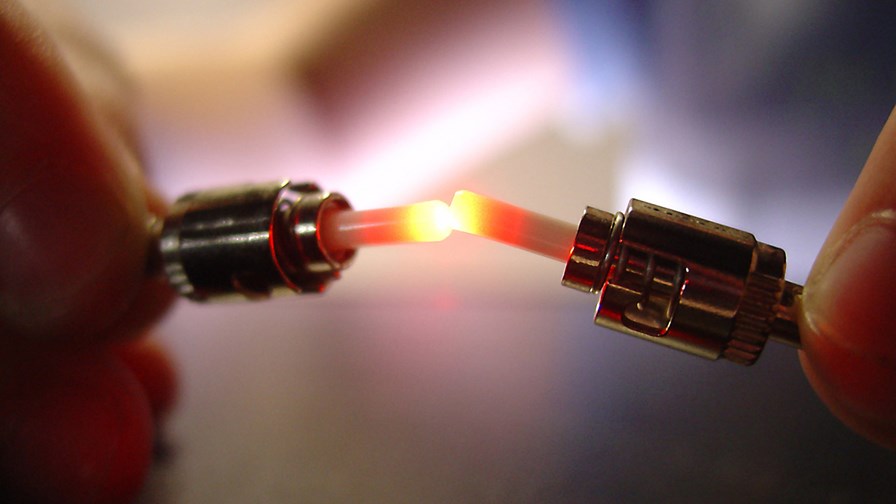

© Flickr/CC-licence/Barta IV

- Iliad takes up TIM’s co-investment offer for FiberCop

- The upstart operator is expected to enter the fixed services market after the summer

- Iliad has already signed a partnership with Open Fiber

It seems that Iliad’s plan to inflict further misery on its rivals in Italy is gaining traction. After creating a price war on the mobile market with the launch of a low-cost offer in 2018, Iliad is building up a strategy to enter the fixed services market, and has just signed its second deal with a fibre network provider.

Iliad Italia took a first step towards entering the fixed market last year, when it agreed a partnership with state-backed broadband operator Open Fiber. Now, Telecom Italia (TIM) announced that Iliad plans to invest in FiberCop, which is building a last-mile network grid in Italy.

Iliad is taking advantage of TIM’s “co-investment” offer for FiberCop, which aims to encourage operators to participate in the construction of a secondary access network and accelerate the rollout of fibre-to-the-home (FTTH) services across Italy. TIM said it will also offer Iliad access to the primary fibre network.

FiberCop started operations in April after TIM completed shareholder agreements with KKR Infrastructure and Swisscom-owned Fastweb. KKR now owns a 37.5% stake and Fastweb took a 4.5% shareholding after transferring its 20% stake in FlashFiber, its joint venture with TIM (which holds an 80% stake), into FiberCop. TIM is also finalising another agreement with Tiscali.

Now that Iliad has two, albeit slightly different, Italian fibre deals under its belt, it looks well positioned to launch its bid for a share of Italy’s fixed market. Also worth noting is that its two fibre partners could eventually become one, although TIM’s plan to merge FiberCop with Open Fiber to create a single fibre network remains up in the air.

It’s not yet entirely clear when Iliad plans to launch fixed broadband services, as well as packages of fixed and mobile offerings, although the suggestion is that it has now been delayed until after the summer.

The operator has previously made it clear that it intends to make its move this year, an event no doubt viewed with some trepidation by its rivals. Benedetto Levi, CEO of Iliad Italia, said in March that its success on the mobile market had motivated it to bring the same rivoluzione to the wireline space.

Revolution is not complete hyperbole in this case: Iliad Italia’s July 2018 launch of a low-cost mobile plan, including 40 GB of mobile data and unlimited minutes and texts for EUR 6.99, sparked a huge price war that currently seems to have no end in sight. In their scramble to respond, and much like their counterparts in France following the launch of the Free Mobile offer in 2012, rival operators quickly launched their own low-cost brands.

Now, Italy’s mobile market closely resembles a bunfight, with TIM’s Kena Mobile, WindTre’s Very Mobile and Vodafone’s ho introducing increasingly competitive offers to win over customers. Iliad Italia gained 7.8 million mobile customers in three years, picking up a further 600,000 new users in the first six months of 2021. According to the operator, it now has a 10% share of the mobile market.

Meanwhile, Iliad founder Xavier Niel has made a move to buy out the other shareholders in the group, which has 40 million customers across France, Italy and Poland. Niel believes the company’s “ambitious” strategy can be best executed if Iliad is a private company, a sentiment that mirrors that of Patrick Drahi, who took another European service provider, Altice Europe, private through a similar move earlier this year.

Niel’s aim? To become a "leading telecommunications player in Europe" with a focus on 5G and fibre-based broadband, of course. He is already in deep talks to acquire cable operator UPC Polska from Liberty Global for $1.9 billion in an effort to provide fixed line support for the Play mobile operation it acquired last year.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.