Source: Counterpoint Research

- Global smartphone market continues its growth momentum in the second quarter

- Generative AI (GenAI) is one of the key factors behind the market’s improving performance

- Devices powered by the technology are set for record growth this year, according to IDC

The global smartphone market continued its recovery in the second quarter, driven by the buzz around generative AI (GenAI)-powered devices.

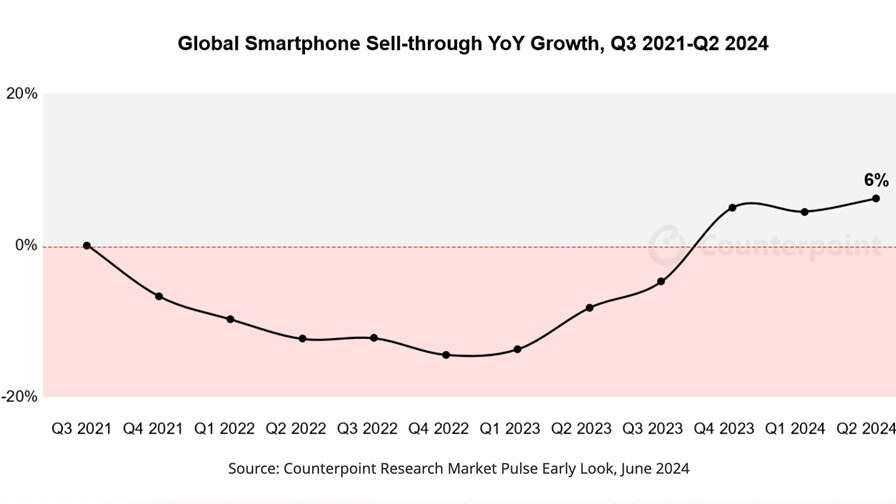

According to the latest reports from two analyst houses – IDC and Counterpoint Research – the sector experienced modest but steady growth in the period between April and June: IDC found global shipments climbed 6.5% year on year to 285.4 million units, while Counterpoint Research put the rise at 6% and did not provide an exact figure of devices shipped.

This is the third consecutive quarter of market growth and the highest year-on-year increase in the sector in the past three years, according to Counterpoint (see graph, above).

The company suggests that smartphone shipments have grown the most quickly in Europe and Latin America, with both regions recording high double-digit growth due to improved consumer sentiment and purchasing activity.

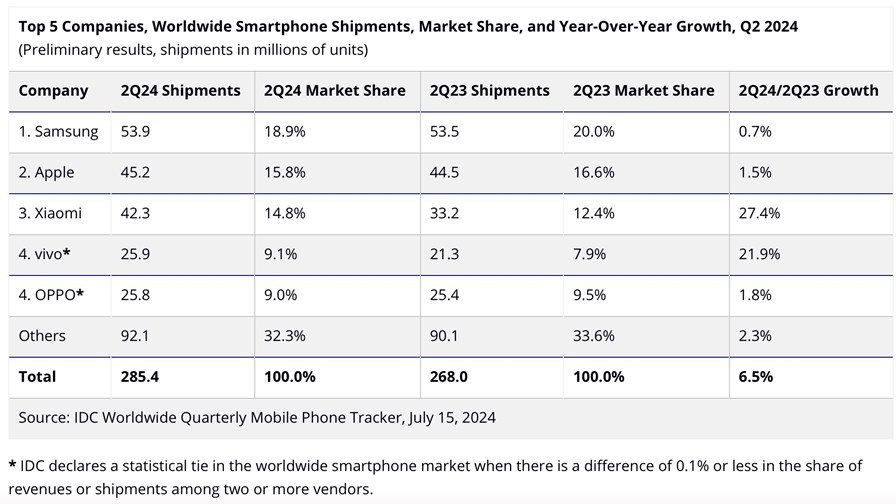

From the vendor perspective, Samsung has retained its crown as the top smartphone maker with a 18.9% share of shipments, according to IDC’s estimates (see table, below).

IDC attributed the South Korean giant’s success to “a strategic focus on its flagships and a strong AI strategy”. Samsung “led the sales of GenAI-capable Android smartphones and is expected to further capitalise on it with its new-generation foldables,” added Counterpoint in its analysis.

Indeed, since the beginning of the year, Samsung has launched a number of premium models that have been marketed based on their AI-enabled capabilities. The company’s main rival, Apple, was the second-largest player with a 15.8% market share, recording improved performance in China and other key regions. Xiaomi ranked third with a 14.8% market share, but Counterpoint cited it as the vendor with the highest growth rate in the period (22%). The top five were rounded out by Vivo and Oppo.

“The global smartphone market has entered a new era – one of slow and steady volume growth driven largely by replacement cycles and is now a zero-sum game between OEMs. We expect smartphone volumes to grow slowly in coming years. However, we expect revenues to grow faster than sales, driven by the premiumisation across regions, especially with the rise of newer form factors and capabilities, like foldables and GenAI,” stated Ankit Malhotra, senior analyst at Counterpoint Research.

Although the market is showing signs of recovery, IDC suggested that demand remains challenged in many markets. “While recovery is well underway with the top-five companies all making year-over-year gains, we are seeing increasing competition amongst the leaders and a polarisation of price bands. As Apple and Samsung both continue to push the top of the market and benefit the most from the ongoing premiumisation trend, many leading Chinese OEMs are increasing shipments in the low end in an attempt to capture volume share amidst weak demand. As a result, the share of mid-range devices is challenged,” explained Nabila Popal, research director with IDC’s Worldwide Tracker team.

However, the analyst added that there is “lots of excitement in the smartphone market today thanks to higher average selling prices (ASPs) and the buzz created by GenAI smartphones, [the sales of] which are expected to grow faster than any mobile innovation we have seen to date and forecast to capture 19% of the market with 234 million shipments this year.”

AI was also highlighted as a driving force for the market’s recovery in analyst estimations for the first quarter of 2024 – see Global smartphone market finally on the mend – analysts.

- Yanitsa Boyadzhieva, Deputy Editor, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.