Global smartphone shipment decline presages worse to come – Omdia

By Martyn Warwick

Oct 28, 2022

Source: Omdia

- Shipments down by 7.6% year on year in Q3

- Chinese vendors the worst hit

- Samsung still the market leader despite selling fewer handsets

- Gloomy outlook for all

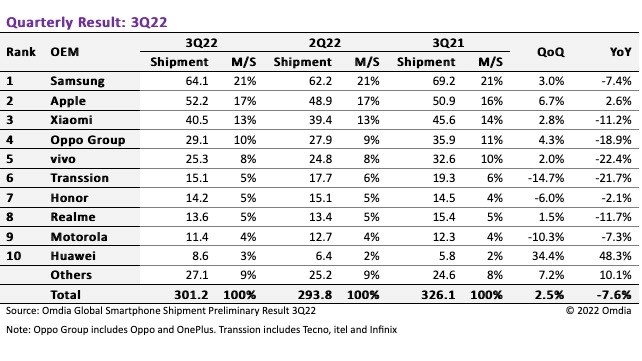

There’s some concerning news in the latest Global Smartphone Shipment Preliminary Result report from industry research firm Omdia, which shows that in the third quarter of this year, global smartphone shipment numbers fell by 7.6% in comparison with the same quarter in 2021. Chinese manufacturers were hardest hit, as shipments from Xiaomi, Oppo Group, Vivo, Transsion and Realme were all down by double-digit figures.

Overall, the total number of handsets shipped during the three-month period to the end of September was 301.2 million units, down from 326.1 million a year earlier, with the decline experienced by the Chinese original equipment manufacturers (OEMs) the primary cause of the slump.

Samsung retained its crown as market leader, shipping 64.1 million smartphones during the quarter, up by 3% compared with its second quarter total but down by 7.4% year on year. As is often the case, Apple found itself in second place in the table, having shipped 52.2 million smartphones in Q3, a 6.7% sequential increase and a 2.6% increase from the third quarter of 2021. Apple tends to lag Samsung except in the fourth quarter of each year when it traditionally, and to much fanfare and ballyhoo, releases its latest premium iPhone offerings to a world agog with anticipation and looking to hand over large amounts of cash during the holiday and festive seasons.

Apple may be in second place in the overall smartphone league table, but it’s the king of the top-of-range premium smartphone sector. In this sub-segment, Apple commanded a 17.3% share in the third quarter, compared with 15.6% in the third quarter of 2021. The Omdia analyst team notes that Apple’s iPhone shipments have grown year on year for eight quarters in a row.

Jusy Hong, senior research manager at Omdia, commented: “Apple outperforming the wider market in the third quarter [is] because its consumers are typically loyal and high-income customers and, as such, are less affected by the current cost-of-living crisis than mid-range brands. Despite the rising gas prices, inflation, and lower disposable income, Apple’s iPhones seem to be more resilient; consumers make cutbacks elsewhere and find a way to save up enough to upgrade to the latest generation of iPhone in a way that owners of Samsung, Honor or OnePlus phones don’t.”

Meanwhile, the big Chinese manufacturers seem stuck in a rut and apparently unable to quickly reverse the decline in their fortunes that have been evident in recent months. In third, fourth and fifth place in the smartphone shipments pecking order (see the table above), Xiaomi, Oppo and Vivo all reported a sequential increase in smartphone shipments during the third quarter of 2.8%, 4.3% and 2% respectively, but this couldn’t make up for the massive declines earlier in the year, when all three logged 20% falls in shipment numbers between the first and second quarters.

Commenting on the crippling figures, Omdia principal analyst, Zaker Li, noted: “The biggest contributing factor to this continued slump is a decline in the Chinese domestic smartphone market, pandemic-related lockdown of major Chinese cities, the Russia-Ukraine war, political conflict in India and the subsequent economic downturn, and increasingly intense competition with Honor and Huawei, which are experiencing rapid growth in the domestic market. Adding fuel to the fire, Xiaomi and Oppo experienced a shortage of components last year and, as a result, significantly increased their purchases in order to secure parts. An unintended consequence of this is a significant increase in inventory, meaning OEMs must continue to downgrade their shipment target for this year and reduce component purchases.” This is not encouraging for a quick recovery.

In seventh place in the league table is Honor which, having shipped 14.2 million devices, is proving itself to be somewhat more resilient than rival Chinese handset makers, recording a mere 2.1% year-on-year decline compared with the double-digit declines of its Chinese peers, as the table above shows. The Omdia team notes that Realme, in eighth place in the table, suffered an 11.7% year-on-year dip not only due to domestic sales pressures but also due to many fewer handsets being sold in India which, hitherto, has been a major market for Realme products.

Away from China, Motorola is in ninth place in the table, having shipped 11.4 million units, a decline both sequentially and year on year, while in 10th place is Huawei, which has clawed its way back into the charts with four successive quarters of consistent growth. The Chinese company’s international travails are well known but, nonetheless, Huawei shipped 8.6 million smartphones in Q3, an increase of more than 48% compared with the same period a year ago.

Omdia’s Hong commented: “In line with Omdia’s forecasting, OEMs’ shipments and targets have fallen and are not expected to rise in the fourth quarter of this year due to growing inventory backlogs. Many other negative factors have also affected consumer demand for smartphones, such as the overall global economic slowdown, inflation, and a strong dollar. Even those without high inventories to shift are reducing their purchase volumes. Overall, total smartphone shipments [so far] this year are 8.2% down on where they were at this time last year, and we expect this trend to continue in the fourth and final quarter of 2022.”

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.

Subscribe