Source: Dell'Oro Group

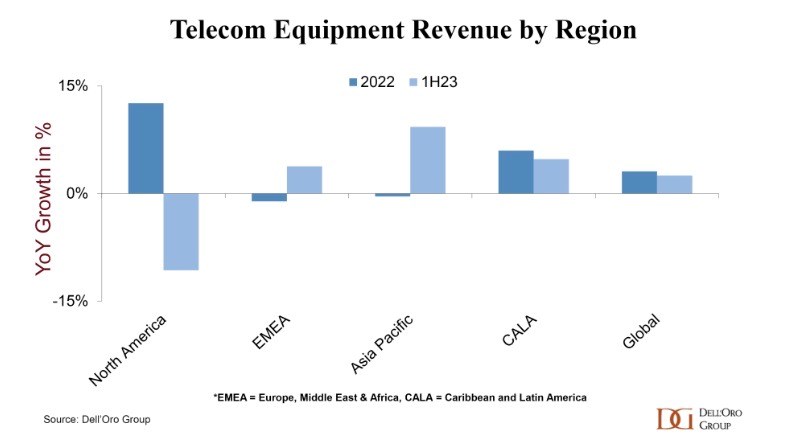

- The global telecom equipment sector grew in value by 2% in the first half of 2023, according to Dell’Oro Group

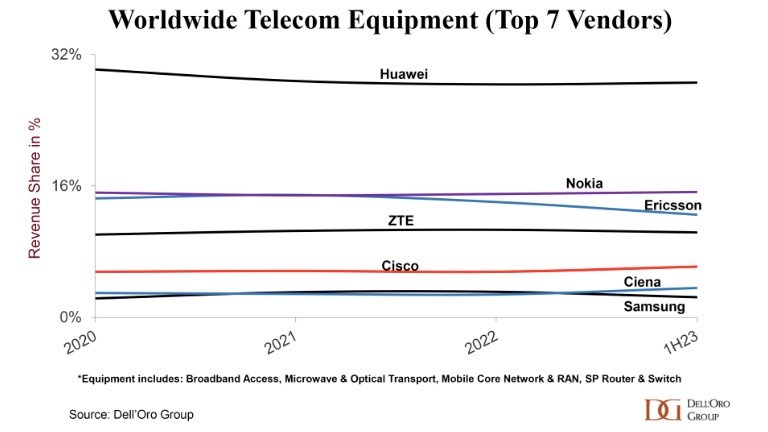

- Huawei is still by far the largest single vendor

- Spending by operators in North America has dipped dramatically this year

- But increased investment elsewhere has more than offset that shortfall

Huawei is still by far the largest telecom equipment vendor in a global sector that managed to grow in value over the first half of this year despite a significant decline in spending by North American operators, according to research firm Dell’Oro Group.

The analyst firm tracks spending in six telecom networking technology categories – broadband access, microwave transport, optical transport, mobile core network (MCN), radio access network (RAN), and service provider router and switch. Together, the spending in these categories comprises the global telecom equipment sector (as defined by Dell’Oro – every analyst house has its own way of looking at the overall market).

According to the Dell’Oro team, the revenues generated during the first half of 2023 by the vendors in those equipment categories was 2% greater than in the first six months of 2022, even though network operator investments in North America dipped dramatically, something that was reflected in the most recent financial reports from both Ericsson and Nokia – see Ericsson, Nokia suffer from capex crunch.

“After five years of expansion, during which the North America region advanced by around 50%, the pendulum swung toward the negative in the first half,” noted the Dell’Oro team in this announcement. “The decline in North America was anticipated, but the pace of the contraction was slightly faster than expected. Alongside more challenging 5G comparisons and inventory corrections affecting some technology segments, North American broadband access equipment spending dropped to its lowest levels in nearly two years in the second quarter,” it added.

Fortunately, spending was up in the other regions, as the chart below shows. “Worldwide telecom equipment revenues, excluding North America, increased by 7% in the first half, supporting the thesis that the telecom equipment market remains robust outside of the US,” noted the Dell’Oro team.

Source: Dell'Oro Group.

The research company didn’t provide a value for the global spending during the first half of this year, but the total value of the telecom equipment sector for the whole of 2022, as tracked by Dell’Oro, was about $100bn.

Huawei is still the undisputed market leader, as the chart at the top of this page shows, despite the ongoing impact of US sanctions and limits on what it can provide to network operators in markets such as the UK. According to Dell’Oro. Huawei “continues to dominate the market outside of North America, accounting for 35% to 40%” of equipment revenues during the first half of this year. That figure is, of course, helped massively by its commanding position in China, where it has a market share of more than 50%, but it is still supplying technology to network operators in most markets.

As for the other main vendors, Nokia’s market share has held firm thanks to its broad portfolio of wireline as well as mobile network infrastructure products, whereas Ericsson’s share has dipped due to its greater reliance on wireless network spending. Ciena’s market share is growing as supply chain and product investor pressures ease, as was reflected in its latest financial results.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.