Source: Point Topic

- Research firm reports that fibre-to-the-premises (FTTP) subs growth in UK is faster among altnets than major ISPs

- Altnets accounted for nearly 30% of retail UK FTTP connections at the end of Q2 2024; market leader BT had a 37% share

- Stinging rebuke for Virgin Media O2’s “premium pricing” for consumer FTTP

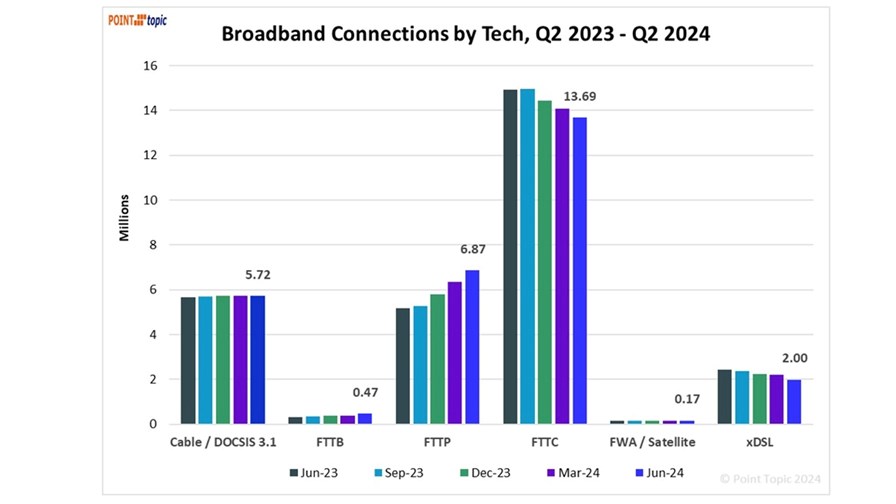

- While FTTP’s star is on the rise, fibre-to-the-cabinet (FTTC) is on the wane against a backdrop of stagnation in the overall size of the UK broadband market

When it comes to growth rates in retail FTTP (fibre-to-the-premises) connections, the UK’s ‘altnets’ – when viewed collectively – seem to be holding their own compared with their bigger and more established ISP rivals, according to respected broadband sector research firm Point Topic.

According to Point Topic’s latest quarterly update on UK ISP and network supplier metrics quarterly update on UK ISP, which covers the three months to 30 June 2024, the combined broadband customer base of the UK’s altnets – all of which are hooked up to full-fibre access networks – totalled 2.06 million at the end of June: That’s a quarter-on-quarter increase of 29% and a 32% jump when compared to the end of June 2023 (1.56 million).

There are still dozens of broadband altnets (alternative network operators) across the UK, with Community Fibre, Gigaclear, Hyperoptic, Netomnia and Vorboss among the more significant names in the sector.

“Altnets are keeping pace with the UK’s major ISPs,” asserted Point Topic research analyst Veronica Speiser in a video presentation of the report’s main findings, which included the ongoing shift towards FTTP connections and away from fibre-to-the-cabinet (FTTC) and xDSL lines.

BT Consumer still holds pole position in terms of retail FTTP market share – 2.7 million customers out of an estimated 7.34 million retail and business full-fibre connections as of 30 June – but the incumbent’s growth rates are slower than the chasing pack of altnets. Point Topic reports that BT Consumer added 172,000 FTTP connections during Q2, which is a 22% year-on-year rise.

Compared with ISP heavyweights Sky Broadband, Virgin Media O2 (VMO2) and Vodafone, UK altnet growth performance fares even better. “Although [the three ISPs] are adding full-fibre connections quarter-on‑quarter, their numbers are not as high as they should be considering the size of their footprints,” noted Speiser. (Troubled TalkTalk continues to see its consumer customer base shrink but, more encouragingly, announced recently a refinancing deal with its lenders.)

Speiser was particularly scathing about VMO2, whose “premium [FTTP] pricing when they are no longer the premium player” made the joint venture vulnerable to cheaper options from altnets offering services with similar broadband speeds.

Point Topic reports that VMO2’s combined RFoG (radio frequency over glass) and FTTP footprint reached around 5 million at the end of the second quarter, yet take-up penetration continues to decline, slipping from 35% (Q2 2023) to 32.6%.

“With a footprint growth of 6% per annum, subs growth should be around 3% but it’s 0.3%,” said Speiser. “[FTTP pricing strategy] is something that VMO2 needs to look at in the future.”

Altnet take-up rates on the up

The all-important take-up penetration rates vary among the FTTP footprints of “mid-tier” wholesale and retail altnets, ranging between 5% and 30%. Speiser thought they were performing “pretty well” on this metric with an average take-up rate of around 15% (up from 13% a year previously). The higher take-up penetration rates, she added, tended to be in areas where altnets have been operating for more than 18 months.

Despite the encouraging FTTP growth stats, the UK altnet market is (still) overcrowded and hyper‑competitive. Point Topic, for example, tracks 106 altnet providers ranging from local ISPs to larger providers with national coverage.

More worryingly for altnet investors looking for attractive returns, the research firm notes that nearly 7.7 million premises in the UK had access to two or more FTTP networks, and that 1 million were covered by three or more full-fibre access players.

Continued consolidation in the UK altnet market seems inevitable to most market watchers, including Speiser. She tellingly highlighted that the aggregated FTTP footprints of 16 (unidentified) mid-tier altnet operators would cover 13.55 million premises, which is not too far off the FTTP footprint of Openreach (14.82 million premises), the quasi-autonomous wholesale fixed access infrastructure arm of BT.

Mixed broadband bag for Openreach

Openreach is now rolling out FTTP at a jaunty pace. Speiser says it hit its target of passing just over 1 million premises with fibre during the second quarter and that its average build rate reached 78,000 premises per week. Openreach seems on track to meet its goal of passing 25 million premises with fibre by the end of 2026. FTTP is the rising broadband technology star in the UK, while fibre-to-the-cabinet (FTTC) is on the wane (see chart above).

Stiffer altnet competition and weaker market conditions, however, help explain why Openreach reported a net loss of 318,000 broadband connections during the first half of 2024. Speiser doesn’t see the drop as cause for too much concern at the BT offshoot.

“Openreach, considering the size of its footprint, will weather the storm as its coverage dominates and altnets continue to consolidate,” she said. “Openreach net broadband losses are not likely to get much worse over the next two quarters.”

Growth in the overall UK broadband market (including copper and satellite technologies) continues to stall, hovering around a total of 29 million retail and wholesale connections for more than a year.

- Ken Wieland, Contributing Editor, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.

Subscribe