montage © Globalstar and Apple

- Apple makes major investment in Globalstar

- Nokia pilots APIs with Hrvatski Telekom

- Huawei looks to 5G and AI opportunities

In today’s industry news roundup: Apple invests in Globalstar to expand its satellite network; Nokia brings its Network as a Code platform to Croatia; Huawei goes multidimensional with 5G; and much more!

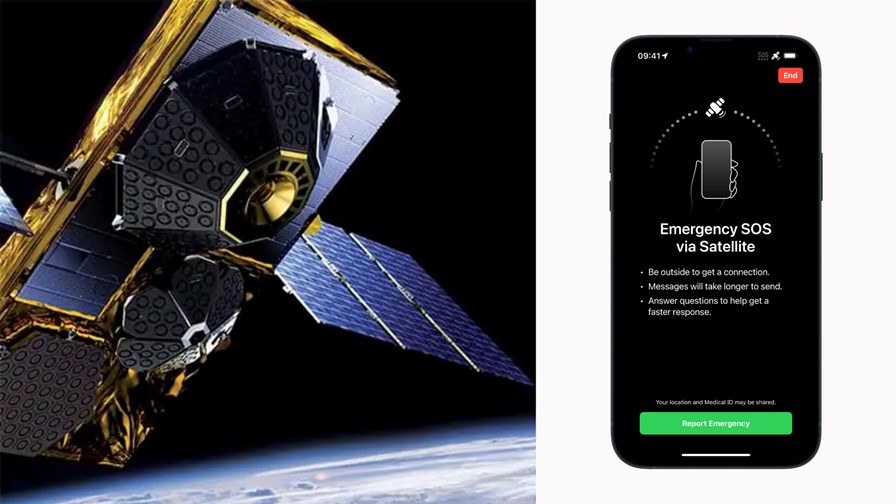

In an SEC filing disclosure made today, Globalstar announced that Apple is investing up to $1.1bn in the satellite company along with new service fees. Apple is already a customer of Globalstar (it invested $450 million in 2022), and uses the operator’s constellation of satellites to support its Emergency SOS service on its iOS devices in select countries. The new deal will enable Globalstar to deliver expanded services to Apple over a new mobile satellite services (MSS) network, which includes a new satellite constellation, expanded ground infrastructure and increased global MSS licensing. This “extended network” will be owned and operated by Globalstar and its subsidiaries (which it refers to as Globalstar SPE), although Apple will become a passive equity holder with 20% equity. The total investment is split between the $1.1bn infrastructure contribution, which will be funded over the construction period on a quarterly basis, and an additional amount to settle debt repayments. Apple will also prepay some service fees, tied to the cost of the extended MSS network and performance bonuses. The payment of service fees of $30m annually will “be accelerated”. Those of you who enjoy (and understand) SEC filings can read lots, lots more here. Meanwhile, Globalstar will retain control of the board of managers of the Globalstar SPE and retain 100% of all terrestrial, MSS and other revenue. It will continue to allocate 85% of its network capacity to provide satellite services to Apple across existing and new satellites, and will use the remaining capacity to service its other MSS customers. Apple launched its Emergency SOS service with the iPhone 14 in 2022 and has previously said the service will be free to use until 2025. There has been no news yet on whether or not Apple will now start charging customers to offset its $1.1bn investment.

Nokia has said it is collaborating with Hrvatski Telekom, the largest operator in Croatia and part of Deutsche Telekom Group, on pilot projects that connect Nokia’s Network as Code platform to the CSP’s network assets. The aim is to enable developers to harness and monetise the Hrvatski Telekom’s 5G network assets and capabilities through the creation of new consumer, enterprise and industrial applications for its customers in Croatia and other parts of Europe. The pilot work features several of Nokia’s API ecosystem partners, including global cloud communications platform Infobip and technology company Elmo. “Offering a simplified developer experience is key to making network APIs commercially attractive,” said Matija Ražem, VP of business development at Infobip. “The strong partnership between Nokia, Hrvatski Telekom and Elmo is yet another demonstration of how the growing ecosystem of APIs is producing tangible solutions for providers and end users. Infobip is playing a key role as a CPaaS [communications platform-as-a-service] platform by offering APIs to enrich the services available in the market.” Developers using Nokia’s platform can access 5G and 4G network capabilities through software development kits, which support functions such as network insights, quality of service on demand, and device location. “Ensuring high-performing networks, foundational for the launch of new use cases across industries and businesses not only Croatia but across the globe, is essential for developers in creating new game-changing applications,” said Boris Drilo, CTIO at Hrvatski Telekom. Read more.

Speaking at the Global MBB Forum 2024 in Istanbul this week, Yang Chaobin, Huawei’s board member and president of ICT products and solutions, announced that: “The upcoming mobile AI era will create huge opportunities for the mobile industry and profoundly shape the decade to come.” According to Yang, two trends have emerged thanks to rapidly evolving 5G and 5G-Advanced (or 5.5G as Huawei prefers) and AI technologies. The first trend is “mobile going AI”, where mobile internet services are being transformed by new service and business models. The second trend is “AI going mobile”, where business opportunities are being unlocked by new mobile services like smart vehicles and robots. Yang explained that 5.5G networks can support the diversified connections, experiences and services that are needed to address these new requirements coming from AI agents, smart vehicles and embodied intelligence. “Evolving 5.5G technology will be the key to unleashing the potential of mobile AI,” he added. And in a challenge to copy editors the world over, Huawei unveiled its 5G-AA solutions (believe us, getting a superscript A to work across the various platforms and frameworks of the web is no easy task). Cao Ming, vice president of Huawei and president of Huawei’s wireless solution, said that the new solutions, “build multidimensional ultimate network capabilities through the full-series Advanced Radio, enable full-domain site digitalisation through Ambient Site, and achieve L4 network autonomy through the agent-based digital engineers team.” It's all here.

New findings released today from Berg Insight reveal that more than 6.3 million cellular routers and gateways were shipped globally during 2023, at a total market value of approximately $1.6bn. Annual sales grew at a rate of 3% year on year. The firm says that growth was dampened by high inventory levels among customers and weaker demand in the industrial segment. It believes that until 2028, annual revenues from the sales of cellular routers and gateways are forecasted to grow at a compound annual growth rate (CAGR) of 12% to reach $2.8bn at the end of the forecast period. High-speed 4G LTE technologies and 5G have made cellular a viable alternative to wired networks and cellular SD-WAN an increasingly mainstream choice among businesses. Leading the market, according to Berg Research, is Ericsson (through its 2020 acquisition of Cradlepoint), with a comprehensive portfolio of routers and adapters along with cellular-centric SD-WAN and security services. Teltonika Networks is in second place and, whilst long being a dominant player in Europe, is now growing its international presence. Other vendors that hold significant market shares are Cisco, Semtech and Digi International. Berg calculates that these five vendors generated $796m in combined annual revenues from the sales of cellular routers and gateways and together hold a market share of 50%.

AT&T has partnered with Simetric, a US-based IoT lifecycle management platform company, to help its business customers manage and monitor IoT endpoints across global operators and different access technologies. It will provide an IoT console with “single-pane-of-glass” management, avoiding the need to manually switch to their multiple connectivity management platforms. According to GSMA Intelligence, IoT connections are forecast to reach more than 38 billion by 2030. As companies continue to adopt and deploy more IoT connected devices, the complications of managing a portfolio of remote endpoints becomes increasingly difficult. Plus, businesses face the growing challenges of SIM management, detection of usage anomalies and cybersecurity risks. “Bringing existing devices along with the ability to manage customers’ carriers in a single, consolidated platform will enable AT&T to further drive business process optimisation and automation for customers,” said Allen Boone, Simetric CEO. Mike Van Horn, assistant vice president of AT&T Connected Solutions, added: “It’s all about removing the complexity to help businesses scale. Customers need these tools to get the most out of their IoT investments.”

– The staff, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.

Subscribe