Source: BusinessWire

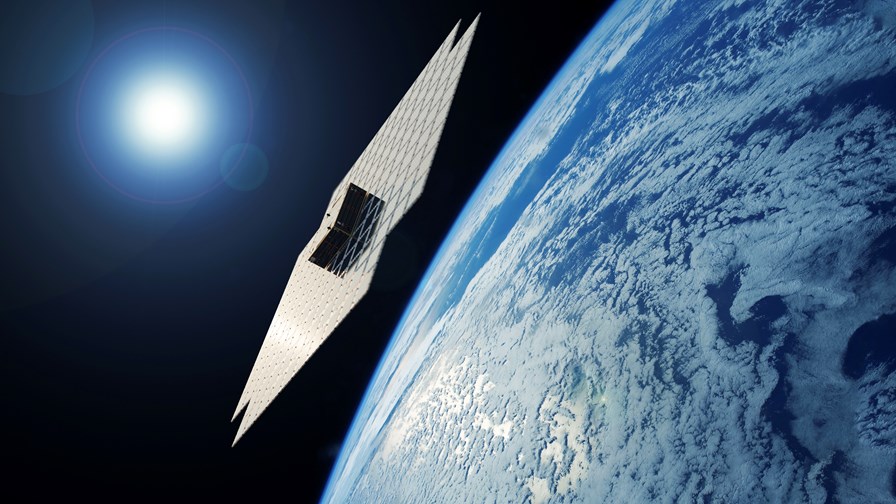

- AST SpaceMobile readies satellite launches

- Direct-to-cellular market value set to take off

- Ericsson and STC trial new feature for network performance boost

In today’s industry news roundup: AST SpaceMobile plans launch of commercial satellite fleet, having now completed the construction phase; its announcement comes just as ABI Research depicts a bullish picture for the future of the ‘direct-to-cellular’ market; Ericsson and STC announce an industry-first with a new automated radio resource partitioning software feature for network optimisation; and much more!

AST SpaceMobile, the operator that aims to build “the first and only space-based cellular broadband network accessible directly by everyday smartphones”, is edging closer to delivering commercial connectivity services, having just announced that it has completed the construction of its first five commercial satellites. Dubbed Bluebirds, the satellites are ready for shipment in the first week of August followed by a seven-day launch window in September. The satellites have undergone “rigorous testing” to ensure they meet the demanding requirements of operations in space, noted AST SpaceMobile. Each ‘bird’ has communications arrays measuring 693 square feet and the company’s CEO and chairman, Abel Avellan, explained that the satellites were built following successful tests of AST SpaceMobile’s in-orbit BlueWalker 3 satellite. Avellan added that the new satellites will provide nationwide “non-continuous service with over 5,600 cells in premium low-band spectrum, with a planned 10-fold increase in processing bandwidth” across the US. The announcement on the completed construction of the fleet comes after, in the first half of this year, the company secured additional funding from major industry players AT&T, Verizon, Google and Vodafone, and won a contract with the US government. AST SpaceMobile claims that its partner portfolio includes more than 40 mobile operators globally, which have more than 2.8 billion subscribers in total.

AST’s progress is evidence of the increased interest in satellite direct-to-cellular business models. Analyst firm ABI Research has released its latest forecast for the market sector, which it believes will be worth more than $17bn by 2032, representing a compound annual growth rate (CAGR) of 40%. “The market is now rapidly shifting from narrowband emergency services supported on specific devices by non-terrestrial network (NTN) IoT [internet of things] protocols to two-way messaging and data services over terrestrial LTE, MSS [mobile satellite services], and NTN standards via satellite,” explained Andrew Cavalier, satellite communications senior analyst at ABI Research. “We anticipate the seamless access of Starlink and Apple Satellite connectivity on devices will attract new and existing customers to leverage this technology when outside terrestrial coverage.” He added that users will expect these services to be affordable if not completely bundled together in more premium service offerings, with the widespread launch of commercial services expected before the end of 2024. The release of the iOS 18 and Android 15 operating systems and the expected commercial launch of SpaceX’s direct-to-cellular (D2C) Starlink network later this year could propel NTN from a niche solution into “a mainstream force that could shape the future of global ubiquitous connectivity”. Cavalier noted that the increased launch capacity within the satellite industry has set the stage for a surge in SatCom applications, benefitting from an abundance of lower-cost satellite services: “NTN is primed to experience a surge in popularity, and ecosystems players, such as chipset vendors alongside organisations like the Mobile Satellite Services Association are helping bridge the gap in technology, connectivity, and collaboration.”

Ericsson and STC have claimed an industry-first with the implementation of automated radio resource partitioning (RRP) on a 5G standalone (SA) network slice. The automated RRP is a software feature that is driven by intent-based automation, and involves “the dynamic and intelligent allocation” of radio resources to different configured slices to optimise network performance. The demonstration took place in a live network environment with a select group of users, using a dual-mode 5G core from STC and equipment from Ericsson, along with the automated RRP software feature. “The successful implementation of the new software will allow STC Group to transition into a high-performing, programmable network powered by 5G-Advanced. It will also simplify operations, underscoring the group’s commitment to pioneering advancements in the telecommunications industry,” noted the Swedish vendor in a statement. Read more.

The trend for telcos to be bolstering their fibre play is in full swing, with the latest development coming in the form of Belgian operator Proximus, which has unveiled plans to become the full owner of a fibre joint venture (JV) it created with EQT Infrastructure in 2021. The operator has agreed to buy the investment company’s majority stake in Fiberklaar for €246m, boosting its shareholding from its current 49.67% stake to full ownership. In its statement unveiling the move, Proximus noted that the deal will ensure “enhanced strategic autonomy and increased flexibility for Proximus” in the deployment of fibre in the region of Flanders where Fiberklaar has been focusing its efforts. According to the telco, the move will also “generate synergies” by optimising funding costs and enabling an exchange of best practices in fibre deployment. Following the deal, which is expected to close in the coming days, Fiberklaar will pursue its operations as a standalone entity within the Proximus Group and will continue to be led by its current management team.

UK operator Virgin Media O2 (VMO2) has reported a 1.4% year-on-year decrease in revenue for the second quarter of 2024 to £2.7bn. The telco’s CEO, Lutz Schüler, noted that this decline was predominantly due to mobile hardware headwinds, with handset revenues plunging the most in the period compared to any of its other segments, down 19.5% year-on-year to £288m. Business-to-business (B2B) fixed services revenue was also significantly lower, down 15.5% to £108m. The company also reported slight losses in fixed line and mobile customer figures. On the bright side, though, Schüler highlighted VMO2’s “significant pace” in fibre deployments, with the telco’s footprint having hit the 5 million premises mark, as the company pushes ahead with its aim to create the UK’s largest national fibre challenger. “Our 5G mobile connectivity now covers almost two-thirds of the UK population and the team pulled out all the stops to hit our Shared Rural Network target, improving mobile coverage in rural areas of the country”, the telco’s chief added.

Customers across the UK registered fewer complaints about landline, fixed broadband and pay-TV services in the first quarter of this year compared to the last quarter of 2023, according to the latest findings from Ofcom, the country’s telecoms watchdog. NOW Broadband was found to be the most dissatisfying broadband service provider in the period, mainly due to the way customers’ complaints had been handled. Virgin Media received the second-highest number of complaints in terms of broadband players, followed by Vodafone, EE and TalkTalk. Of the landline service providers, NOW Broadband, EE and Virgin Media scored the highest number of grievances by customers. Virgin Media was the least satisfying pay-TV provider, while Sky and EE received the fewest complaints. In terms of mobile services, total complaints were up slightly between January and March compared to their level in the fourth quarter of 2023. O2 UK remained the most complained-about mobile operator, with the way in which customer complaints were handled the biggest grievance. At the other end of the scale, Tesco Mobile, Sky Mobile, EE and Vodafone received the fewest complaints in the opening quarter. “We’re pleased to see a fall in complaints based on the previous quarter – and we’re especially heartened by an improvement among some providers we have engaged with following previous poor performance. However, there is still room for improvement across many services. It’s notable that a major issue for customers is how providers deal with their complaints – this drives many of the complaints we receive, so is clearly an area where providers must raise their game,” noted Ofcom’s policy director, Fergal Farragher. Find out more.

- The staff, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.