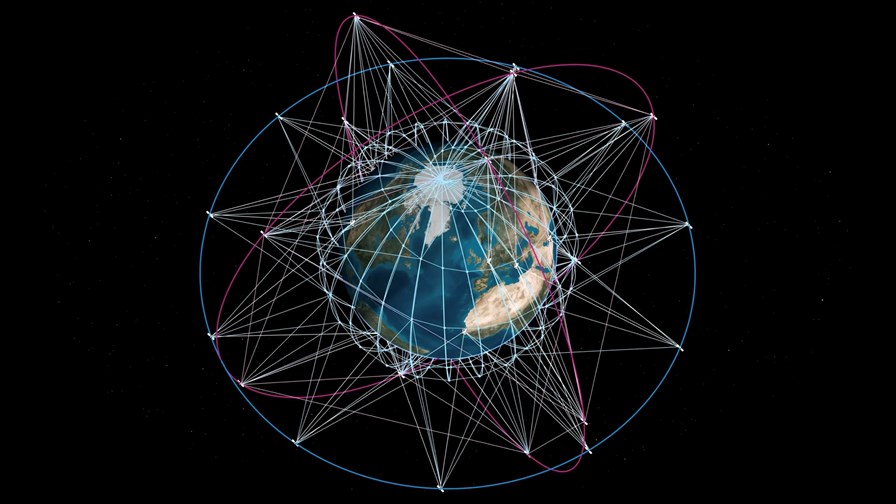

Picture credit: SES

- Europe forges ahead with €10.6bn satellite play

- T-Mobile US signs up users for direct-to-cell beta service

- Private equity firm lines up a run at Telecom Italia

In today’s industry news roundup: Contracts have been signed for the construction and operation of Europe’s next-generation, €10.6bn satellite communications constellation, IRIS2; T-Mobile US is seeking beta users for the satellite-to-smartphone service it is launching with Elon Musk’s Starlink; CVC Capital Partners is interested in buying Vivendi’s stake in Telecom Italia and might just have its eye on taking total control of the Italian telco ; and much more!

Contracts worth €10.6bn over 12 years have been signed for the construction and operation of Europe’s IRIS2 (Infrastructure for Resilience, Interconnectivity and Security by Satellite) constellation, which will provide secure services to European Union member states via 290 low-earth orbit (LEO) and medium-earth orbit (MEO) satellites. The European Commission has signed a concession contract with the SpaceRISE consortium of companies that includes three European satellite network operators – SES, Eutelsat and Hispasat – and a range of partners including Deutsche Telekom, Orange, Thales Alenia Space, OHB System, Airbus Defence and Space, Telespazio, Hisdesat, and Thales Six. The constellation’s funding comprises €6bn from the EU, €550m from the European Space Agency (ESA) and €4bn from the private sector, explained the ESA in this announcement. “With IRIS2, the European Union is solidifying its position as a global leader in secure satellite connectivity, ensuring resilience in the face of emerging challenges. This programme not only addresses today’s connectivity needs but also lays the groundwork for Europe’s strategic autonomy in a digitalised world,” noted the EC in this statement. “IRIS2 is not just a technological achievement – it is a testament to Europe’s ambition and unity,” stated Henna Virkkunen, the EC’s executive VP for tech sovereignty, security and democracy. “This cutting-edge constellation will protect our critical infrastructures, connect our most remote areas and increase Europe’s strategic autonomy. By partnering with the SpaceRISE consortium, we are demonstrating the power of public-private collaboration to drive innovation and deliver tangible benefits to all Europeans,” she added. In this announcement from SpaceRISE, Eutelsat’s CEO, Eva Berneke, noted: “IRIS2 programme is a landmark initiative that embodies Europe’s commitment to digital sovereignty, resilience, and strategic autonomy. At Eutelsat, we are uniquely positioned to bring unparalleled expertise to this mission, leveraging our pioneering capabilities, including our cutting-edge LEO constellation. By combining this advanced infrastructure with the collective strengths of the SpaceRISE consortium, we will deliver a transformative communications backbone that addresses Europe’s most critical connectivity needs of our governments, reinforces its leadership in space innovation, and bridges the digital divide for millions of citizens and businesses across the continent.” Now comes the hard part – getting the satellites built, into orbit and operational and that will take years – commercial services are not due to be launched using the IRIS2 constellation until 2030.

T-Mobile US has opened registration for the beta service trial of T-Mobile Starlink, the “direct-to-cell satellite service that will help eliminate dead zones by providing coverage for the 500,000 square miles of land in the United States not covered by earth-bound cell towers”, the operator has announced. The telco has been working with Elon Musk’s LEO satellite operator, Starlink, since August 2022 and the service, which enables connectivity from satellites to regular smartphones, is now ready to be put to the test by the general public following approval from US regulator the Federal Communications Commission (FCC) for T-Mobile US to offer such services from space using its licensed spectrum, provided it doesn’t interfere with other networks. “T-Mobile Starlink is the first major low-earth orbit constellation in the world paired with terrestrial cellular spectrum, making the phone in your pocket work in areas of the US that have never, and probably never will, have ground-based coverage,” stated Mike Katz, president of marketing, strategy and products at the telco. “It’s a truly groundbreaking engineering breakthrough and means that we are one step closer to helping T-Mobile customers have confidence that, no matter where they are, if they can see the sky, they will be covered by T-Mobile.” Read more.

Private equity firm CVC Capital Partners is in preliminary talks about the potential acquisition of Vivendi’s stake in Telecom Italia (TIM) and is also mulling an eventual takeover of the Italian telco, according to Bloomberg. French media giant Vivendi is the single largest shareholder in Telecom Italia, with a stake of almost 24% of the telco’s ordinary shares (which gives it about 17% of the company’s total capital, including preference shares) – that stake is currently worth more than €1bn. Vivendi, which is currently undergoing a restructuring of its asset holdings, fell out with the Telecom Italia board and management team over the protracted sale of the Italian telco’s fixed line access network assets to KKR, a move that Vivendi opposed as it believed the network assets were grossly undervalued at €22bn. But Telecom Italia got the deal over the line earlier this year, leaving it with its enterprise, mobile and international business units, so Vivendi is likely open to offers for its stake in what is left of Telecom Italia. CVC reportedly believes there is untapped value in what is left of Telecom Italia and might fancy a full takeover if it acquires Vivendi’s stake, but such a move would almost certainly face a giant hurdle in the form of the Italian government, which also holds a stake in the telco and which regards Telecom Italia as an important national asset.

Still with Telecom Italia… Sparkle, the international network and services arm of the Italian telco, has joined forces with shipbuilding group Fincantieri to jointly develop “innovative technological solutions for the surveillance and protection of submarine telecommunications cables,” TIM has announced. “Through shared and specialised work teams, Fincantieri and Sparkle will analyse the requirements for improving the security of undersea telecommunications infrastructures, identifying innovative technologies and solutions to ensure their operational resilience,” noted the Italian telco, adding that Fincantieri “is developing advanced solutions for surveillance and protection of subsea infrastructure, combining its established know-how in the shipbuilding industry with cutting-edge technologies.” The move is topical, as subsea communications cables are increasingly being targeted by ‘bad actors’ that seek to cause disruption and unrest: For example, recent cable cuts in the Baltic Sea were blamed on sabotage. Sparkle, meanwhile, looks set to have a new owner in the not-too-distant future: Italy’s Ministry of Economy and Finance and Retelit, a provider of communications and IT services to the Italian enterprise sector, are set to table a takeover bid by 18 December.

The global SASE (secure access service edge) sector was worth $2.4bn in the third quarter of 2024, up by just 1% year on year, with the six leading vendors – Zscaler, Cisco, Palo Alto Networks, Broadcom, Fortinet and Netskope – collectively holding a 72% share of the market (compared with 65% a year earlier), according to research firm Dell’Oro Group. “The SASE market is entering a maturity phase, driven by consolidation and innovation from top vendors,” noted Mauricio Sanchez, senior director of enterprise security and networking at Dell’Oro. “As enterprises focus on trusted, integrated solutions during economic uncertainty, the largest vendors are capturing a growing share of investments, setting the stage for continued leadership and innovation,” he added.

Sanchez has also been analysing the global network security technology market, which was worth more than $6bn in the third quarter, up by 8% year on year. The sale of hardware-based solutions stabilised for the first time in more than a year, according to Dell’Oro. The third-quarter trends highlight “a pivotal moment where enterprises balance investments across physical, virtual, and SaaS security solutions,” noted Sanchez. “However, the long-term trajectory clearly favours SaaS and virtual solutions as they align with evolving enterprise security strategies,” he added.

SoftBank CEO Masayoshi Son has pledged to invest $100bn in the US during Donald Trump’s upcoming tenure as president, with the investments set to focus (not surprisingly) on AI and its supporting infrastructure, CNBC has reported. The investments are expected to help create 100,000 jobs in the US.

Following a “detailed national security assessment”, the UK government has approved Bharti Enterprise’s acquisition (via Bharti Televentures) of a 24.5% stake in BT Group “on the basis that BT will establish a National Security Committee within BT to oversee strategic work that BT performs which has an impact on or is in respect of the national security of the United Kingdom.” The giant Indian conglomerate, which is also the parent company of India’s second-largest telco, Bharti Airtel, announced in August this year that it had struck a deal to acquire the 24.5% stake in BT held by Patrick Drahi’s Altice UK – see India’s Bharti Global snaps up Drahi’s 24.5% stake in BT.

– The staff, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.