- After a couple of declines, the global smartphone market grew by 6.4% in 2024

- Apple and Samsung are still the market leaders but their market shares dipped below 19%

- Xiaomi made great strides, growing its annual market share to 13.6%, according to IDC

- The influence of, and market share gains by, Chinese vendors is growing

After a couple of well documented challenging years, the global smartphone sector grew in 2024, with research firm IDC estimating (based on preliminary figures) that the number of devices shipped last year grew by 6.4% to 1.24 billion, driven largely by the success of Chinese vendors, such as Xiaomi.

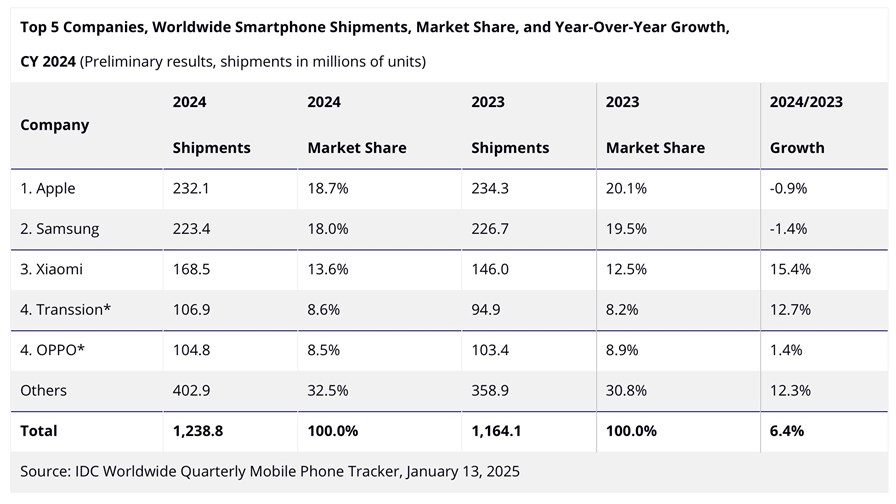

Apple and Samsung are still the clear market leaders, as the table above shows, but both saw their market share numbers dip year on year to 18.7% and 18% respectively, as they shipped slightly fewer smartphones compared with 2023 – Apple’s annual device shipment total dipped to 232.1 million in 2024, down from 234.3 million the previous year, while Samsung’s total fell to 223.4 million compared with 226.7 million in 2023, according to IDC.

The big winner in 2024 was Chinese vendor Xiaomi, which saw its shipments grow to 168.5 million in 2024, compared with 146 million in 2023, and its market share increase to 13.6% from 12.5% the year prior. That success has been reflected in its financial performance – its revenues for the first nine months of 2024 grew by almost 30% year on year to 256.9bn yuan ($35bn), while its share price has leaped by almost 138% in the past 12 months to HKD 33.75on the Hong Kong stock exchange.

“The strong growth witnessed in 2024 proves the resilience of the smartphone market as it occurred despite lingering macro challenges, forex [foreign exchange] concerns in emerging markets, ongoing inflation, and lukewarm demand,” stated IDC’s senior research director for worldwide client devices, Nabila Popal.

“Vendors successfully adjusted their strategies to drive growth by focusing on promotions, launching devices in multiple price segments, interest-free financing plans, and aggressive trade-ins – fueling premiumisation and boosting low-end devices – especially in China and emerging markets,” she added.

Those tactics resulted in gains, mainly for the Chinese smartphone vendors. IDC noted that Apple and Samsung lost market share due to the “super aggressive growth of Chinese vendors… [which] drove the overall market by focusing on low-end devices, rapid expansion and development in China.”

That trend was especially noticeable in the fourth quarter of 2024, when 331.7 million smartphones were shipped in total, according to IDC.

“This past quarter was particularly remarkable for the largest Chinese smartphone vendors: Xiaomi, Oppo, Vivo, Honor, Huawei, Lenovo, realme, Transsion, TCL, and ZTE,” stated Francisco Jeronimo, VP for EMEA client devices at the research firm. “They achieved a historic milestone as they shipped the highest combined volume ever in a quarter, representing 56% of the global smartphone shipments in Q4. While their core markets remain China and Asia, these brands are rapidly expanding their footprint throughout Europe and Africa, driven by the strong performance of their low-end and mid-range devices. Notably, Huawei stands apart, with most of its shipments in the high-end and premium segments, underscoring its distinct market positioning in China,” added Jeronimo.

And what of the year ahead? The IDC team expects the market to continue growing in 2025, albeit at a slower pace. But there are obstacles.

“While we remain optimistic about continued growth in 2025, the threat of new and increased tariffs from the new US administration has elevated uncertainty across the industry, driving some players to seek preventative measures to mitigate risks; however, thus far, the impact has been minimal,” stated IDC’s Popal.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.