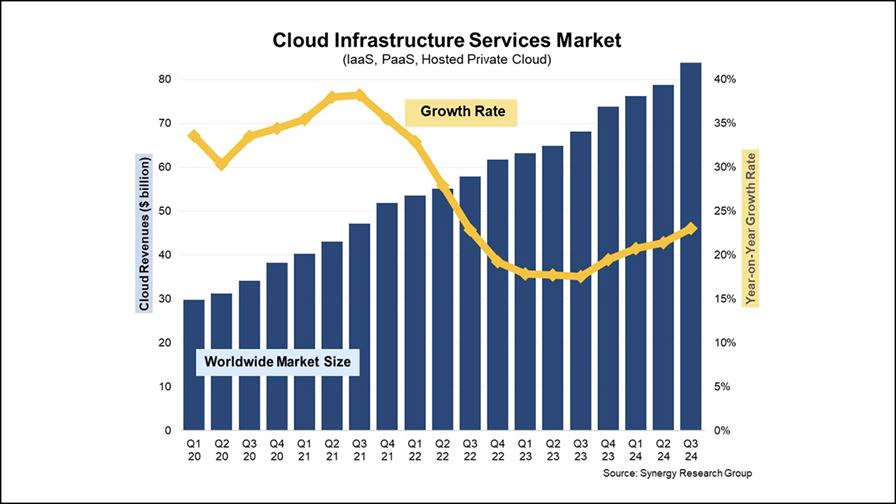

- The already massive cloud infrastructure services sector is not just growing – it’s growing at an increasingly rapid pace

- The sector was worth almost $84bn during the third quarter, according to Synergy Research Group

- The year-on-year growth rate has increased for the past four quarters and reached 23% in Q3

The global cloud infrastructure services sector grew at an accelerated rate during the third quarter of this year to be worth a staggering $83.8bn (an average of $913m per day during the July-to-September period), up by 23% year on year, according to the latest market statistics collated by Synergy Research Group.

In the 12 months to the end of September, the market was worth $313bn.

Growth rates had stabilised in 2023, as the chart above shows, but the growing popularity of generative AI (GenAI) applications is now having an impact on the cloud infrastructure services sector, which comprises infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and hosted private cloud services.

“It is not like the market was in trouble in late 2022 and most of 2023, as a $60bn-plus market was growing at around 18%, which was quite impressive for such a large market,” noted John Dinsdale, a chief analyst at Synergy Research Group, in comments emailed to the media. “But it has now gone to another level with accelerated growth rates pushing the market to $84bn in Q3. AI is clearly a big factor behind that growth surge… New AI-oriented services and technology are helping the major cloud providers to ride a wave – new capabilities lead to increased demand, which leads to increased revenues, which then enables more investment in underlying technologies,” according to Dinsdale.

“Relative to early 2023, each of the big three cloud providers have seen growth rates improve, with a particularly strong uptick at Amazon [AWS] and Google,” he added.

Amazon Web Services (AWS) “maintains a strong lead in the market, though Microsoft and Google again had higher percentage growth numbers. All three have seen their growth rates increase from 12 months ago, with particularly strong improvements at Amazon and Google,” according to the Synergy Research team.

Amazon Web Services (AWS) is still by far the biggest player, with a market share in the third quarter of 31%: It reported third-quarter revenues of $27.5bn, up by 19% year on year, and an operating profit of almost $10.5bn, up 50% year on year.

Microsoft Azure’s Q3 market share was 20%, equal to about $16.8bn. In its recent third-quarter earnings report, Microsoft reported total cloud revenues of $38.9bn, up 22% year on year, but this includes software-as-a-service (SaaS) revenues, which are not included in Synergy Research’s cloud infrastructure services analysis. Indeed, the analyst firm notes that it has reviewed and changed the way that Microsoft Azure revenues are categorised, with some now recognised and restated as SaaS rather than IaaS or PaaS.

Google Cloud is the third-largest player with a market share of 13% in the third quarter. It reported revenues of almost $11.4bn, up by 35% year on year, and an operating profit of $1.95bn, up by more than 630%. The cloud division’s sales growth was driven mainly by “accelerated growth in Google Cloud Platform (GCP) across AI infrastructure, generative AI solutions, and core GCP products,” the company noted in its earnings report.

Sundar Pichai, CEO of Google and its parent company, Alphabet, noted in a blog post that Google Cloud “has real momentum, and the overall opportunity is increasing as customers embrace GenAI,” and called out the strength of GCP’s AI infrastructure, “which we differentiate with leading performance, driven by storage, compute and software advances… as well as leading reliability and a leading number of accelerators.”

The three hyperscalers, with a combined market share of 63%, are still way ahead of any other cloud infrastructure services players, with Alibaba (4% market share) and Oracle (3%) the next two-biggest companies. Salesforce IBM, Tencent and Huawei each command a market share of around 2%, with Akamai, Baidu, China Telecom, China Unicom, Fujitsu, NTT, Snowflake, SAP and VMware cited as other smaller companies in the sector.

Geographically, the cloud infrastructure services market is growing strongly in all regions: “When measured in local currencies, the major countries with the strongest growth included India, Japan, Brazil and Italy, all growing at rates above the worldwide average,” noted Synergy Research. The US market is still by far the largest – indeed, it is bigger in value than the whole of the Asia Pacific region.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.