Source: Vodafone

- Vodafone has published its fiscal third-quarter results

- The operator is still in limbo in many ways due to ongoing M&A processes and the impact of regulation

- But it looks like things are coming to a head in this calendar year and there are encouraging trends from Vodafone Business

- Vodafone remains in M&A talks in Italy despite having rejected Iliad’s merger offer

- The operator is also about to undertake a monster radio access network gear procurement process

Vodafone Group has been in flux for several years already and is still tangled up in a transformation process that has multiple moving M&A and operational parts, but there are signs that 2024 might be the year when the operator, which plies its trade across Europe and Africa, clears a number of hurdles and gets a clear run at some profitable growth, especially in the enterprise services sector.

The operator reported total group revenues of €11.37bn for the fiscal third quarter that ended 31 December 2023, up by 4.2% on an “organic” basis (excluding exchange rate fluctuations, the impact of M&A and other one-time factors), while service revenues came in at €9.38bn, representing organic growth of 4.7%. As this is an interim trading update, the operator doesn’t provide profit margin numbers for the quarter (at this stage at least).

As the trading update shows, the telco’s problems still lie mainly in Spain and Italy, both of which reported a year-on-year dip in sales. But these are also markets where Vodafone is working on an exit: The €5bn sale of the Spanish operation to Zegona Communications looks set to be completed in the coming months; while Vodafone Group CEO Margherita Della Valle noted during a webcast for investors and financial analysts on Monday morning that, despite the breakdown of talks with Iliad regarding a potential €10bn-plus merger in Italy, the operator is still in other M&A discussions to deliver the most “value-creating” outcome for investors in the country, adding that she is unable to discuss the matter currently as negotiations are ongoing.

Della Valle also noted that M&A plans were progressing well in the UK, where the Competition and Markets Authority (CMA) has launched a formal investigation into the proposed £16.5bn merger of Vodafone UK and Three. The CEO will be hoping to bring M&A matters to a conclusion in all three markets before this calendar year is over (though any agreement in Italy will likely spill into 2025).

There are challenges of a different sort in Vodafone’s largest single market, Germany, which generates about 30% of the entire group’s services revenues, but there’s light at the end of the tunnel there too: The operator is in the process of trying to retain 8.5 million legacy cable TV customers in multi-dwelling units (MDUs) that have, until now, been tied to Vodafone through collective deals with housing associations, but those customers are now free to cut their ties with Vodafone and get their service from other providers. Vodafone has been preparing for this eventuality for some time and is now a few weeks into the process of re-signing or losing those customers and, according to the CEO and her CFO Luka Mucic, all is going as expected and that more telling data will be available by the end of the financial year (March). The worst case scenario is that the operator loses all of those customers and up to €800m in annual revenues, but that doesn’t seem like a possible outcome.

However, some customers will certainly be lost and Vodafone Germany’s numbers will be affected, but both the CEO and CFO, without committing to exact numbers, suggested that Vodafone Germany’s annual revenues would likely be flat in the 2024-25 financial year and then grow after that, with growth from the Vodafone Business arm of the operation, which provides services to enterprise customers, helping to make up for any legacy TV revenue losses in the coming quarters.

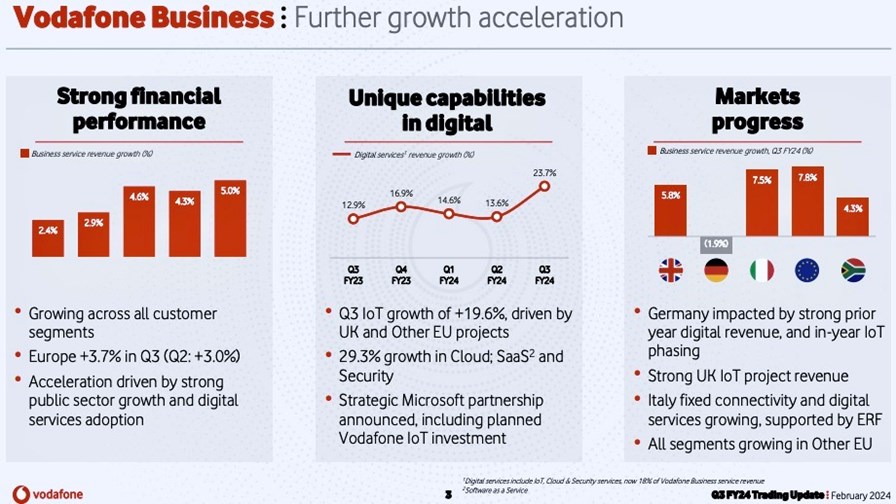

Vodafone Business looks to be something of a lifesaver for the operator just now: It’s practically propping up the shrinking business in Italy and, overall, generated revenues of €2.62bn in the fiscal third quarter, representing 5% organic growth. The operator noted that demand is particularly strong for digital services, with cloud and internet of things (IoT) revenues boasting year-on-year sales growth of over 20%.

Della Valle said that the scaling up of Vodafone Business is one of the strategic imperatives she identified when she took on the CEO role early last year and noted that “demand is very strong – it’s really on us to equip ourselves to better serve it. Which is why you have seen, for example, that my first big business partnership has been with Microsoft, precisely because it fits very well. With this objective, I’m really keen to leverage partnerships to ensure that we build on our strength, bringing in external capabilities to accelerate our growth,” she added.

That Microsoft partnership is the 10-year deal Vodafone announced in mid-January that will, among other things, see the two companies co-develop enterprise services and will involve Microsoft investing in Vodafone’s IoT business – see Vodafone makes its digital services, GenAI bed with Microsoft.

Not only will that relationship generate new business opportunities but it will also help Vodafone reduce its costs: CFO Mucic noted during the trading update webcast that by shifting its IT assets (tens of thousands of servers) and applications to Azure from its existing leased datacentre facilities, the operator is on course to reduce its cloud-related costs by an unspecified three-digit millions of euros figure.

That’s not Vodafone’s only cost-cutting exercise, of course: Early in her tenure, Della Valle announced a three-year headcount reduction programme that would impact 11,000 Vodafone staff and she noted that the process was about one-third completed already.

Another area where Vodafone is looking to become more efficient is in its radio access network (RAN), and with that in mind it has just launched what the operator believes is the largest RAN equipment tender in the world (outside of China) for technology that will be used by operating units across the group, a move that the CEO said will lead to “better results for all”.

The question in the vendor community right now, especially following the recent decision made by AT&T and the long-time and very vocal support that Vodafone has given to Open RAN, is just how much of this giant tender process will result in meaningful deals for alternative RAN suppliers, such as Samsung and Mavenir. All eyes will be on the slices of the pie that Ericsson and Nokia manage to hang on to (or even grow).

In the meantime, Della Valle is working hard to keep investors on board and execute a business turnaround story. “Vodafone is changing and we’re seeing the impact of our focus on our priorities of customers, simplicity and growth… We are transforming our shared operations to be a simpler business. Vodafone Business growth is accelerating in line with our ambitions… and after announcing our transactions in the UK and Spain, we are engaged in constructive discussions in Italy,” she concluded.

For now, shareholders remain unmoved: Vodafone’s share price dipped by almost 3% during Monday trading and currently stands at a very weak 66.6 pence on the London Stock Exchange, very near its 52-week low. The CEO will be hoping that the only way is up from hereon.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.