Source: Proximus

- Belgium’s national telco closed the takeover of CPaaS player Route Mobile last month

- It now expects the addition will aid its ambition to be a major international digital service provider (DSP)

- The operator says Route Mobile is a ‘game-changer’ and hopes it will help its international business revenues to top €2bn within the next two years

Nearly a month after completing the acquisition of a majority stake in communications platform-as-a-service (CPaaS) specialist Route Mobile, Proximus is now targeting international business revenues of between €2bn and €2.5bn by 2026.

The Belgian national operator presented an updated vision for its role in the communications services sector now that it has added India-based Route Mobile to its portfolio of international services, stating that it aspires to become “a worldwide leader in digital communications”.

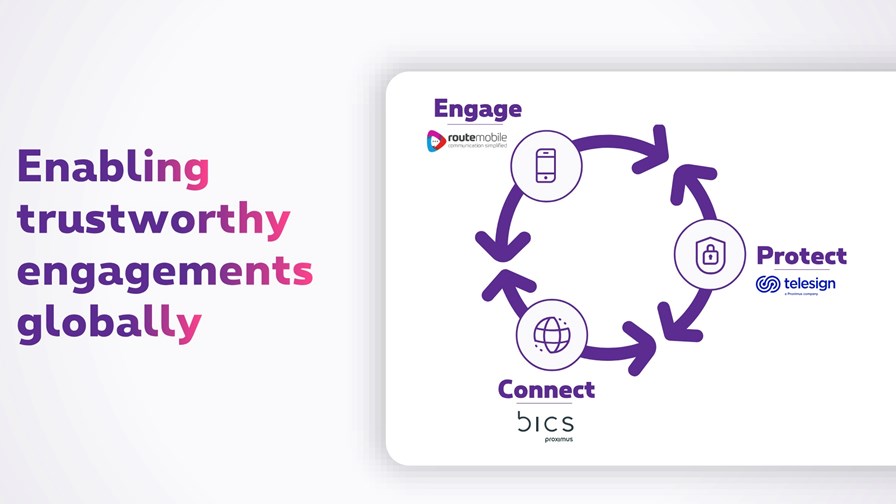

As part of this vision, Proximus expects Route Mobile, as well as its other subsidiaries BICS (connectivity services) and Telesign (digital identity), to help its international segment generate annual revenues of between €2bn and €2.5bn in 2026, up from the pro forma revenues of €1.9bn in 2023.

In addition, the company believes that its global unit will help it deliver “high-quality services with lower cost base”; the unit is set to deliver more than €100m of yearly earnings before interest, taxes, depreciation and amortisation (EBITDA) in 2026.

“The acquisition of a majority stake in Route Mobile is a game-changer on our journey to being a leader in the global digital communications market. Driven by our unique position and powerful differentiators, we want to connect, engage and protect digital communications for our customers and deliver significant value for the group,” commented Guillaume Boutin, CEO of the Proximus Group.

That the international part of its business can grow at a healthy rate will be important for Proximus, as its domestic opportunities are limited by the size of the market and the strong competition from Orange and Telenet. In 2023, its domestic revenues amounted to almost €4.7bn, about 74% of its total sales, while international revenues stood at just over €1.5bn, about 26% of total sales. Route Mobile adds about €400m in annual revenues to that international total and it’s clear the Belgian operator expects the combination of Route Mobile, Telesign and BICS to drive revenue and margin growth over the next couple of years.

In addition to sharing its expectations for the coming years, Proximus also updated its guidance for 2024 to reflect its forecast for “a positive impact from synergies” following the integration of Route Mobile. It now expects its group EBITDA to grow up to 2% year on year, up from an earlier guidance of up to 1% growth. As for its international division – it expects a “mid-to-high single-digit growth” for 2024.

According to Proximus, its high hopes are well justified, as the telco believes it is “perfectly positioned” to capture opportunities in the service sectors addressed by Route Mobile, including peer-to-peer (P2P) voice and messaging, mobility services, CPaaS and digital identity. As such, it cited figures suggesting that the CPaaS market is expected to grow by a compound annual growth rate (CAGR) of between 10% and 15% in the next three years, while digital identity is expected to increase at a CAGR of about 15% and mobility services are forecast to grow by a CAGR of 5% in the period.

The Belgian telco expects to grow its market share in “the mature P2P voice and messaging market”, despite overall declining volumes.

The integration of Route Mobile, which Proximus described as “a pivotal moment for the international ambitions” of the group, was first announced in July 2023, for an initial sum of €643m – see Proximus heats up CPaaS sector with major acquisition.

At the time, the operator agreed to purchase a 58% stake in Route Mobile, but upon completion of the deal its ownership rose to 82.7% in the CPaaS specialist.

- Yanitsa Boyadzhieva, Deputy Editor, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.