- Majority of businesses keen to adopt edge, 5G slicing, private network services within 5 years

- But only a quarter of telcos provide more than just voice and data to most enterprise customers, according to a new study

- Analysys Mason survey suggest operators' share of enterprise IT spending is in decline

Enterprises are champing at the bit for new IT and connectivity services, but telcos need to broaden their portfolios and modernise their technology stacks so they can actually address that demand, according to the findings of a new report from Analysys Mason.

According to the report, Large Enterprises’ Demand for Communications and IT services, which was produced in association with customer engagement and billing system specialist CSG, more than 80% percent of the 200 multinationals surveyed for the study are interested in adopting one or more of either network slicing, edge services or private networking in the next five years.

Furthermore, 92% are accelerating their plans to make greater use of IoT, cloud and unified communications services: Nearly two thirds plan to increase their cloud services spending in the next 12 months.

"There is significant appetite among enterprises to buy additional IT services from their main communications provider," according to Catherine Hammond, principal analyst, Analysys Mason.

"Up to 50% of enterprises today say they already buy cloud, security and IoT services from their main CSP and another 30% would consider buying these services from their CSP in future," she said. "This poses an opportunity for CSPs to continue investing in leading edge technologies that not only broaden their portfolio but enable them to deliver a one-stop-shop to meet enterprise IT needs."

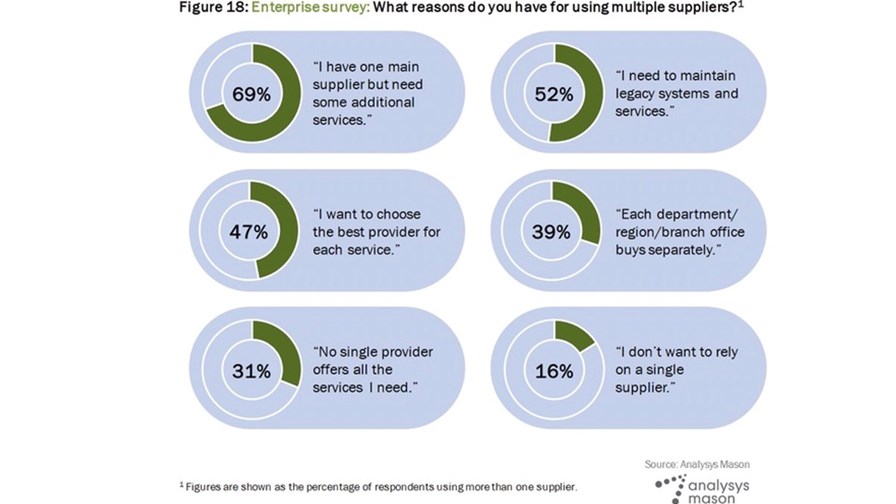

Indeed, according to Analysys Mason and CSG, one of the main gripes today for enterprises is having to shop around at multiple suppliers in order to obtain all the services they require, and as the chart below shows, there are multiple reasons for doing business with more than one supplier.

Source: Large Enterprises’ Demand for Communications and IT services - report from Analysys Mason and CSG

More than 60% of enterprise respondents said they use at least three different suppliers for just their core communications services, and 80% want to cut down on the number of suppliers they use. Meanwhile, only 25% of the 16 CSPs surveyed by Analysys Mason sell IT services to a majority of their enterprise customers, offering further evidence of the disparity between what enterprises want and what telcos can deliver.

This is a problem that telcos need to get on and tackle, because according to the survey, while CSPs are generating an increasing amount of revenue from IT services, it is not growing as rapidly as the amount of money enterprises are spending on IT: That suggests that telcos' share of this spending is falling.

"It's no longer purely about voice and data. Today's enterprises look to their communications provider to deliver a broad ecosystem of products and services that will allow them to unleash the full potential of their business," said CSG COO Ken Kennedy. "To deliver on this promise, CSPs need to modernise their technology stacks to create scalable processes that enable them to bring new products and services to market faster and lead to new revenue streams."

- Nick Wood, reporting for TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.