Source: Vodafone Group

- After 11 months as CEO, Margherita Della Valle puts her stamp on the telco

- It now has divestment deals secured in Italy, Spain and is anxiously awaiting the outcome of an antitrust probe into its planned merger in the UK with Three

- Those deals leave it with operations in European markets where it has reasonable growth prospects

- Vodafone is simplifying its structure, revamping its top team and will focus on a consistent consumer experience, though we’ve heard that promise before

In a lengthy and densely packed announcement issued on Friday morning that included news of a binding deal to sell its Italian business to Swisscom, Vodafone Group CEO Margherita Della Valle unveiled the international telco’s “reshaped European footprint”.

Whether that footprint will resemble the smeared imprint of a yeti, wandering lost in the mist and mud of an English spring, or the crisp outline of a bespoke Oxford brogue of the type sported by Sir Christopher Gent during his tenure as CEO back in the late 1990s, or that of loafers, wedges or dainty Italian mules, remains to be seen. We’ve certainly witnessed some flip-flops over the years, as well as big feet trying to cram themselves into Cinderella’s glass slippers.

However, whatever the reshaped footprint, we can be sure that Vodafone will be pleased with it. The company says today’s announcement is the “final step of the portfolio right-sizing announced in May 2023”, shortly after Della Valle took the helm, adding that the “reshaped European footprint” will be stamped “on growing markets, with strong positions and local scale”.

The release also extols the “value-creating” sale of 100% of Vodafone Italy to Swisscom for €8bn in “upfront cash proceeds” that will be added to the €4bn in cash expected from the impending sale of Vodafone Spain to Zegona, and celebrates the upcoming return of €4bn to investors via share buybacks “as part of a broader capital allocation review.”

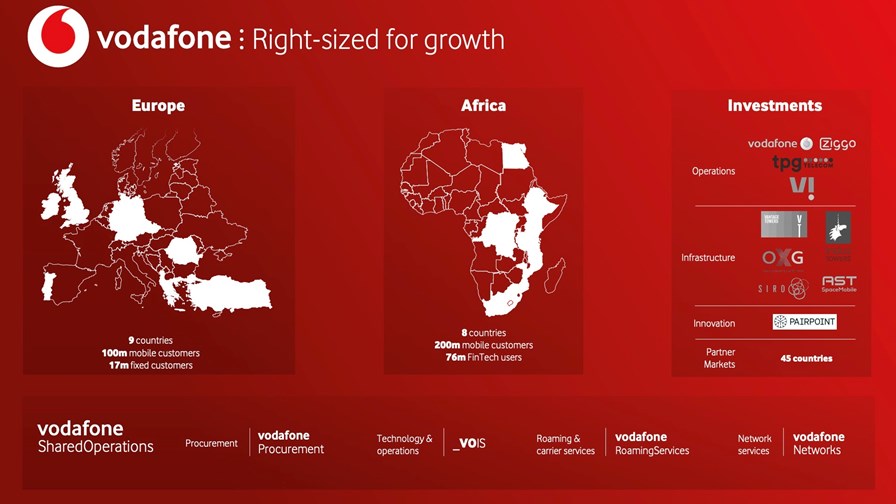

Simultaneously, the group will be reorganised into five divisions: Germany, European Markets, Africa, Vodafone Business and Vodafone Investments. Changes are also being made to the Vodafone Group management team: The main change is in Germany, Vodafone’s single biggest market, where CEO Philippe Rogge is to “step down’ and depart within the next two weeks.

Ahmed Essam, currently the CEO at Vodafone UK, steps up to become CEO of the new European Markets business and executive chairman of Vodafone Germany, while the current Vodafone UK chief commercial officer Max Taylor steps up to become CEO at Vodafone UK and, it seems likely, will be the head honcho of a combined Vodafone/Three operation in the UK if that £16.5bn merger plan emerges intact from the current scrutiny of the UK’s Competition and Markets Authority (CMA) and a review under the UK’s National Security and Investment Act.

It was high time that action was taken by Vodafone in Italy because the asset had proven it could not deliver a return on capital employed (ROCE), a financial ratio used to measure a company’s performance and a good indicator of efficiency, because it measures a company’s profitability after factoring in the capital used to achieve that profitability. In the case of Vodafone Italia, no ROCE was achieved, a state of affairs that is symptomatic of the fact that, as disclosed in the State of Digital Communications Report 2024 compiled by European Telecommunications Network Operators (ETNO), the ROCE achieved by its members fell by almost half during the five years between 2017, when it was 9.1%, and 2022, by which time it had dipped to 5.8%. This slump was seen as clear evidence that it is getting increasingly hard for telcos across Europe to make even barely adequate returns on their investment, and the years since have borne out that pessimistic prognosis.

It’s hardly surprising then that Vodafone is also releasing itself from the financial drag that characterises its Iberian holdings and is selling Vodafone Spain to the UK Investment fund, Zegona Communications (a vehicle run by the former Virgin Media execs Eamonn O'Hare and Robert Samuelson) for €5bn in a deal already approved by the European Commission. Zegona will continue to operate under the Vodafone brand for the next decade.

As part of its broad announcement, Vodafone issued an investor update. The short stack of webcast slides recaps the telco’s strategic roadmap, indicating that, although for many years Vodafone presented itself as a consumer-focused organisation, it is now focusing equally on the needs of the enterprise as well as the consumer sector. It is also moving on from what it, very belatedly, now admits has long been an inconsistent consumer experience and will go “back to basics” with consumers to “win the market”. Best to watch social media comments on the success of that one.

In addition, the telco’s “complex structure” will be simplified as Vodafone becomes a “leaner organisation focused on value”. Furthermore, the present “suboptimal capital allocation” regime will be replaced by a portfolio that is the “right size” for growth.

A “big growth opportunity” in B2B and in fintech in Africa

In the company’s press release, Della Vella noted: “Today, I am announcing the third and final step in the reshaping of our European operations. Going forward, our businesses will be operating in growing telco markets – where we hold strong positions – enabling us to deliver predictable, stronger growth in Europe. This will be coupled with our acceleration in B2B, as we continue to take share in an expanding digital services market. With the sale of Vodafone Italy and Vodafone Spain, together with the merger of Vodafone UK and Three UK… all telecom markets within the new geographic footprint have been growing over the last three years and we will now accelerate our performance where we can create value.”

One such opportunity is in the B2B sector, as demand for digital services continues to surge and Vodafone is well positioned to support SMEs and public sector organisations, as well as large enterprises, whilst gaining market share. What’s more, from 1 April this year, Vodafone’s new internet of things (IoT) company will attack additional markets and create a platform-as-a-service (PaaS) offering to support other telcos.

Elsewhere, Vodafone says it will seek growth in Africa via mobile connectivity, fixed connectivity and financial services. The telco is already the market leader across its African footprint and sees a significant opportunity to reach a wider share of the population in fixed networks. Meanwhile, M-Pesa, the very successful fintech platform run by Vodacom and Safaricom in Kenya, Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana and Egypt is doing well. It has over 75 million customers and is growing at double-digits rates.

Today’s announcement has enough positive spin that were it a cricket ball, it would easily skittle out Sachin Tendulkar, who is widely regarded as the best cricket player of all time. However, the reality of the situation is that Vodafone is diminished by today’s news: Once upon a time – and not that long ago – the telco had much-vaunted ambitions to be a global force in telecom but in recent years it has exited one market after another, including the US (where, in 2014, it foolishly sold its 45% share in Verizon), Japan and others. Now it is retrenching again to focus on Europe and parts of Africa.

In terms of expansion and success, let’s hope the company isn’t wrong-footed again anytime soon.

– Martyn Warwick, Editor in Chief, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.