Source: Téral Research (Lightcounting)

- The Open RAN sector has attracted a lot of network operator interest

- But it is still a small market with investments driven by just a few operators

- There is not enough momentum and that will result in fewer supplier options

- The market is already dominated by familiar names, notes Stéphane Téral, founder and chief analyst at Téral Research

- But the operators can help each other and the market by coordinating and cooperating as they have done in Japan, according to the analyst

The Open RAN sector has significant potential and has attracted interest from more than 100 network operators, but it is “a long and bumpy journey” and is suffering from wasted resources and a lack of coordination, according to one experienced industry analyst.

Stéphane Téral, founder and chief analyst at Téral Research (the wireless networking offshoot of research house Lightcounting, where Téral continues to work), told attendees at last week’s i14y Lab Summit in Berlin that the Open RAN sector is not developing as quickly as it might because of fundamental inefficiencies and a significant duplication of effort. Japan, on the other hand, is already an “Open RAN nation” because its network operators have collaborated on testing and validation to speed up market developments and as a result have benefitted from speedier progress, he noted.

But Japan is currently the outlier: Government and US pressure resulted in the country’s four operators – NTT Docomo, KDDI, SoftBank and Rakuten Mobile – sharing a “one-stop test OTIC [open testing and integration centre]” for R&D and validation efforts, and each of the quartet is making progress in its own way: Rakuten Mobile is deploying Open RAN-enabled systems across it national networks as it strives to attract millions of customers; NTT Docomo has been testing and deploying for years, “forcing its suppliers to open their interfaces,” noted Téral; KDDI is starting with vRAN; and Softbank is working with Nvidia – see Nvidia and SoftBank team on GenAI, 5G/6G platform and Nvidia smells blood in the RAN.

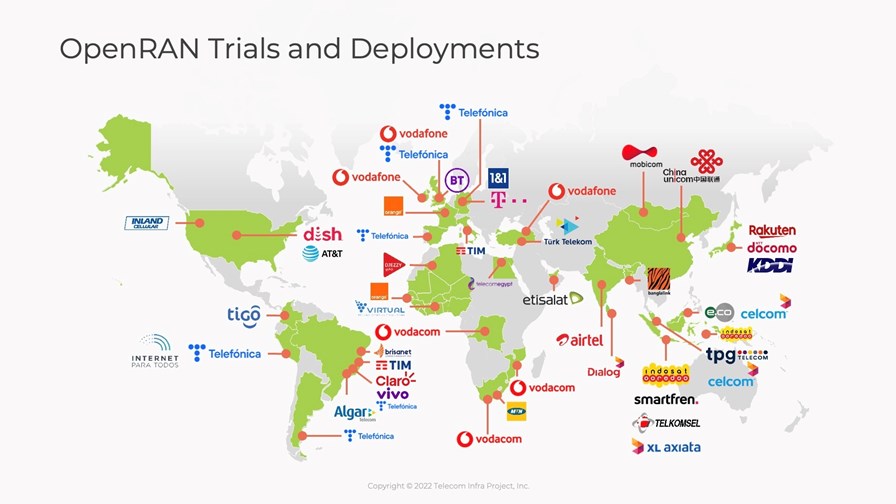

But many operators interested in Open RAN are working in isolation, and there are a lot of them. He pointed to the global map of trials and deployments published late last year by the Telecom Infra Project (TIP) – see the image below – that highlighted about 60 or 70 operators in some level of engagement, but he says while “there are very few rollouts… [there are] lots of testing and validation efforts underway – at least 100 network operators are actively testing and validating Open RAN, and many countries are pouring money into testing and validation,” with the US allocating $1.5bn to Open RAN research and development, and Germany and the UK committing hundreds of millions to the promotion and development of the alternative, Open RAN architectures.

Source: Telecom Infra Project (TIP) 2022

The big problem is that “the bulk of current test efforts focus on the same things, no one is really benefitting and the ecosystem is struggling… the economics of the sector are faltering” and when it comes to the vendors trying to build a business from Open RAN sales, “not everyone is going to make it.”

The Open RAN sector should have been worth more than $2bn in 2022 but it didn’t make that mark. “It fell short because Dish had some delays and the new challenger in Germany, 1&1, had issues – it was due to have rolled out a few thousand sites but it missed that target” due to well documented problems with towers partner Vantage.

“So the market [spending] is still currently driven by Rakuten Mobile, NTT Docomo and KDDI… Japan is leading the way, not just in deployment” but in having the shared testing that has enabled them to “accelerate and make more progress.”

The end game, according to Téral, is “to reduce the effort and accelerate the development. No one is benefitting at the moment… there are already casualties.” Mavenir, he noted, is surviving because it is “throwing money at it,” having raised significant funding in the past year, “Parallel Wireless had to lay off 80% of its staff,” Airspan is suffering, Altiostar was acquired by Rakuten Symphony, and STL got into the Open RAN market and then thought “it smelled funny” and got out.

The current situation is that, mainly, the market is dominated by “the big names we have seen before,” said the analyst. In terms of Open RAN revenues, he identifies NEC, Fujitsu, Altiostar (Rakuten Symphony), Dell, HPE and Intel as the top vendors, and “you will see Samsung coming up” as it grows its business with Dish Wireless in the US. Those that survive will need scale and scope and there are not many that have that currently – Parallel Wireless is one that does not, according to Téral.

And Intel is “being chased by others”, such as Nvidia, AMD (Xilinx), Marvell, Qualcomm and Arm, which “all have scale and scope”.

Why is Nvidia, a company that recently achieved a $1tn valuation, chasing this tiny market? “It sees the future of RAN as mini datacentres and Nvidia is big in datacentres… it is looking to see how the RAN might be reconfigured and how it can take a piece of the cake,” noted the analyst.

So is there a solution to the Open RAN sector’s economic woes? The market needs to “work together, like Japan is doing” and have “one-stop testing” that can accelerate market developments and eradicate inefficiencies.

“Germany can do this – all four main operators – Deutsche Telekom, Vodafone, Telefónica and 1&1 – are all “on the Open RAN bandwagon. So why not bring them together to share and move the needle and accelerate?” he asked.

“Spain is also promising, but you need some work” before Movistar (Telefónica), Orange and Vodafone will collaborate, but “France and Italy don’t care,” especially while there are is a still a major reliance on the Chinese equipment vendors (though that may not last much longer if the European Commission gets its way).

“It’s complicated, but if Germany can lead by example, maybe the other countries can do something,” concluded the analyst.

Is Téral correct? Or too pessimistic? Check out what progress is being made in the sector during our Open RAN Summit and send in questions for our live Q&A sessions on 21 and 22 June to find out what our industry expert speakers think.

- Ray Le Maistre, Editorial Director, TelecomTV