Source: SNS Telecom & IT

- Open RAN investments have been a slow burn

- But a new wave of rollouts, such as AT&T’s in the US, is set to spur the market

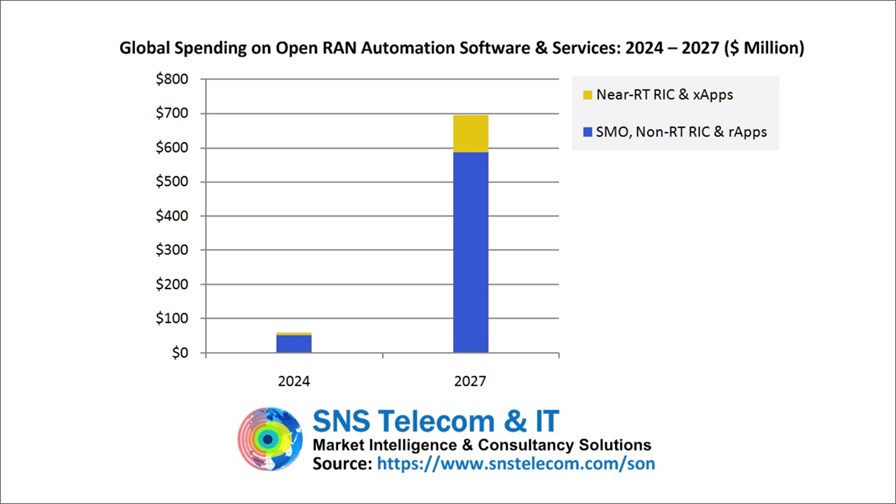

- One research house, SNS Telecom & IT, expects investments in Open RAN automation software, including SMO and RIC solutions, to ramp up to $700m a year by 2027

A new wave of Open RAN rollouts is expected to fuel significant investment in software systems such as service management and orchestration (SMO) solutions over the next few years, and propel the size of the Open RAN automation software sector from about $50m this year to almost $700m in 2027, according to a new forecast from research house SNS Telecom & IT.

The analyst team, led by James Bennett, is very familiar with this sector as it has been tracking the market for self-organising network (SON) solutions (which enable automated processes in traditional radio access network architectures) since 2015. That focus has naturally evolved into coverage of SMO solutions, non-real time and near-real time RAN intelligent controllers (RICs), and the applications (rApps and xApps) that run on RIC platforms, all of which are Open RAN automation software tools. The role of and prospects for all of these technologies are examined in the research firm’s most recent report, RAN Automation, SON, RIC, xApps & rApps in the 5G Era: 2024 – 2030 – Opportunities, Challenges, Strategies & Forecasts.

While the deployment of centralised SON systems, which abstract control from RAN edge nodes for network-wide actions, has been limited in traditional 4G and 5G networks due to a number of limiting factors (most notably interoperability and scalability), the SNS Telecom team believes the potential for Open RAN automation software deployments is strong. That’s because interoperability issues are (in theory) overcome by the open, multi-vendor nature of the Open RAN architecture (adhering to O-RAN Alliance specifications), while the flexible, scalable nature of the underlying, cloud-oriented IT infrastructure that supports virtualised and Open RAN deployments offers a proving ground for AI-enabled SMO, RIC and x/rApp deployments. These, in turn, “enable greater levels of RAN programmability and automation” and “transform mobile network economics by reducing the opex (operating expenditure)-to-revenue ratio, minimising energy consumption, lowering CO2 (carbon dioxide) emissions, deferring avoidable capex (capital expenditure), optimising performance, improving user experience and enabling new services,” according to the research firm.

So what are the benefits that network operators might gain from the deployment of Open RAN automation software? The SNS Telecom team noted that because of the much higher density of radios and cell sites in the 5G era (and higher energy tariffs), “energy efficiency has emerged as one of the most prioritised use cases of RAN automation as forward-thinking mobile operators push ahead with sustainability initiatives to reduce energy consumption, carbon emissions and operating costs without degrading network quality.”

According to the research house, giant Japanese operator NTT Docomo “expects to lower its TCO [total cost of ownership] by up to 30% and decrease power consumption at base stations by as much as 50% using Open RAN automation,” while Docomo’s rival, Rakuten Mobile, “has already achieved approximately 17% energy savings per cell in its live network using RIC-hosted RAN automation applications. Following successful lab trials, the greenfield operator aims to increase savings to 25% with more sophisticated AI/ML models.”

Other use cases of “considerable interest” to mobile operators include “network slicing enablement, application-aware optimisation and anomaly detection.”

This all sounds great, but NTT Docomo and Rakuten Mobile are among a very small number of network operators to have so far committed to any kind of meaningful Open RAN deployments during the past few years.

There are, however, signs that more mobile operators are dusting off and accelerating their Open RAN strategies, sparked in part by an AT&T announcement late last year of a five-year, $14bn plan to build out the next phase of its 5G network using Open RAN technology, with Ericsson as its lead vendor partner. The SNS Telecom team notes that as part of that deployment, AT&T is adopting the Swedish vendor’s SMO and non-real time RIC solution to replace two legacy, centralised SON systems.

And clearly Ericsson, which has branded its SMO as the Ericsson Intelligent Automation Platform (EIAP), is hoping to position itself as a major SMO, non-real time RIC and rApp partner to many operators, as it has developed a multivendor repository/library of rApps, dubbed the rApp Directory, that is already available to “early members of the EIAP ecosystem,” including the likes of AT&T, Swisscom, Telstra and Vodafone from the telco community.

It’s not just AT&T that is fuelling an Open RAN resurgence, though: Canada’s Telus this year unveiled its extensive Open RAN deployment plans, including the deployment of SMO and RIC solutions, with Samsung Networks as its lead vendor partner.

In Europe, notes SNS Telecom, Swisscom is deploying an SMO and non-real time RIC platform “to provide multi-technology network management and automation capabilities as part of a wider effort to future-proof its brownfield mobile network, while Deutsche Telekom is progressing with plans to develop its own vendor-independent SMO framework”. That solution is based on ONAP (Open Network Automation Platform), the open-source network management software stack that is part of the Linux Foundation and it should be noted that Deutsche Telekom has had a tricky time getting vendor solutions and apps to run on its SMO.

In addition, “Open RAN automation is also expected to be introduced as part of Vodafone Group’s global tender for refreshing 170,000 cell sites.”

Such developments, in addition to ongoing specifications developments, interoperability testing and product certification, will light a fire under the Open RAN automation software sector, reckons SNS Telecom. The research firm expects the market to grow at a compound annual growth rate (CAGR) of more than 125% “between 2024 and 2027 alongside the second wave of Open RAN infrastructure rollouts by brownfield operators.” Most of the investments, it believes, will be in SMO, non-real time RIC and rApp (RAN application) solutions (regarded as the evolution of SON systems), rather than near real-time RIC and xApp (extended application) solutions that will enable automated low-latency changes to RAN elements to optimise network operations and spectrum utilisation.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.