Source: Mobile Experts

- The Open RAN tech sector was fuelled by a few greenfield network rollouts

- Those deployments have been largely completed and haven’t been followed by any other large-scale builds

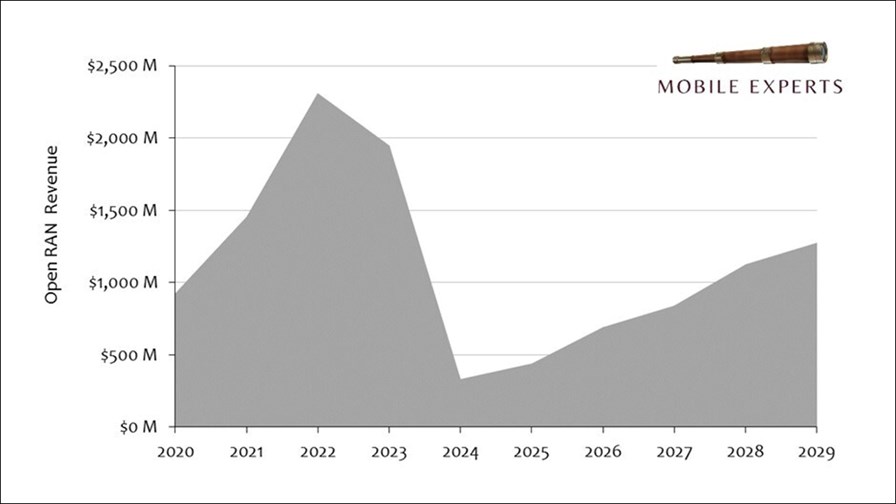

- As a result, the value of Open RAN investments plummeted in 2024 and will recover only gradually in the coming years, according to a Mobile Experts report

The initial Open RAN investment boom is over, with the value of investments in Open RAN networks crashing by a calamitous 83% year on year in 2024 to around $400m from around $2bn last year, according to a new report from Mobile Experts.

Initial rollout investments in build-from-scratch (greenfield) networks by new entrants, such as Dish Network in the US, Rakuten Mobile in Japan and 1&1 in Germany, have now come to an end and have not been followed by other major greenfield rollouts, resulting in what Mobile Experts describes as “the most bizarre market growth profile ever seen in the wireless market”.

“Our revenue chart for Open RAN looks like the Grand Canyon,” stated Joe Madden, principal analyst at Mobile Experts and author of the Open RAN 2024 report. “All of the big clean-sheet O-RAN deployments have finished their major buildout phase, so now the market will transition to upgrades on legacy networks. But legacy networks will use Open RAN differently. Many people don’t understand why legacy mobile operators are rejecting the original Open RAN business model and are choosing a single software business model instead,” Madden added.

As his forecast chart (above) shows, Madden expects the market to grow from the 2024 nadir as major mobile operators revamp and extend their networks with Open RAN technology: US telco giant AT&T and Canadian operator Telus will be two of those, while Vodafone Group continues to develop its Open RAN plans in Europe, and Japan’s NTT Docomo continues to invest – see AT&T goes big on Open RAN with Ericsson and Telus taps Samsung for Open RAN.

There is also now some expectation that Verizon could evolve its virtual RAN (vRAN) deployments with Samsung Networks into an Open RAN architecture, following the recent appointment of Open RAN advocate Yago Tenorio as its CTO.

Other Open RAN investments are planned by operators, such as KDDI in Japan, which is working primarily with Samsung Networks for its deployment, and Deutsche Telekom, while Telefónica continues to include Open RAN in its plans, notably in Germany but also at a group level.

However, that market uptick isn’t necessarily good news for all vendors involved in the Open RAN sector, as Madden notes the growing trend towards single software vendor, rather than multivendor, deployments, which means that whatever business there is will be concentrated with just a few suppliers: AT&T’s award of a major contract to Ericsson, which is the sole provider of cloud RAN and associated management and orchestration software for the US telco’s Open RAN rollout, being a key example of that trend.

And the overall value of the market isn’t much to shout about either, with Madden expecting annual Open RAN investment levels to not even reach $1.5bn by 2029, still some way off the levels seen in 2021 until 2023, despite significant investments from the US government into Open RAN R&D – see US allocates $420m for Open RAN radio unit R&D.

While Madden’s outlook will dent the hopes of Open RAN hopefuls, such as Mavenir, Parallel Wireless and the slew of vendors developing low-cost Open RAN radio units, other industry watchers are more optimistic, with long-time mobile network sector analyst Stéphane Téral predicting the market will be worth $8bn by 2029 – see Tier 1 telcos to drive Open RAN’s second growth cycle – report.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.

Subscribe